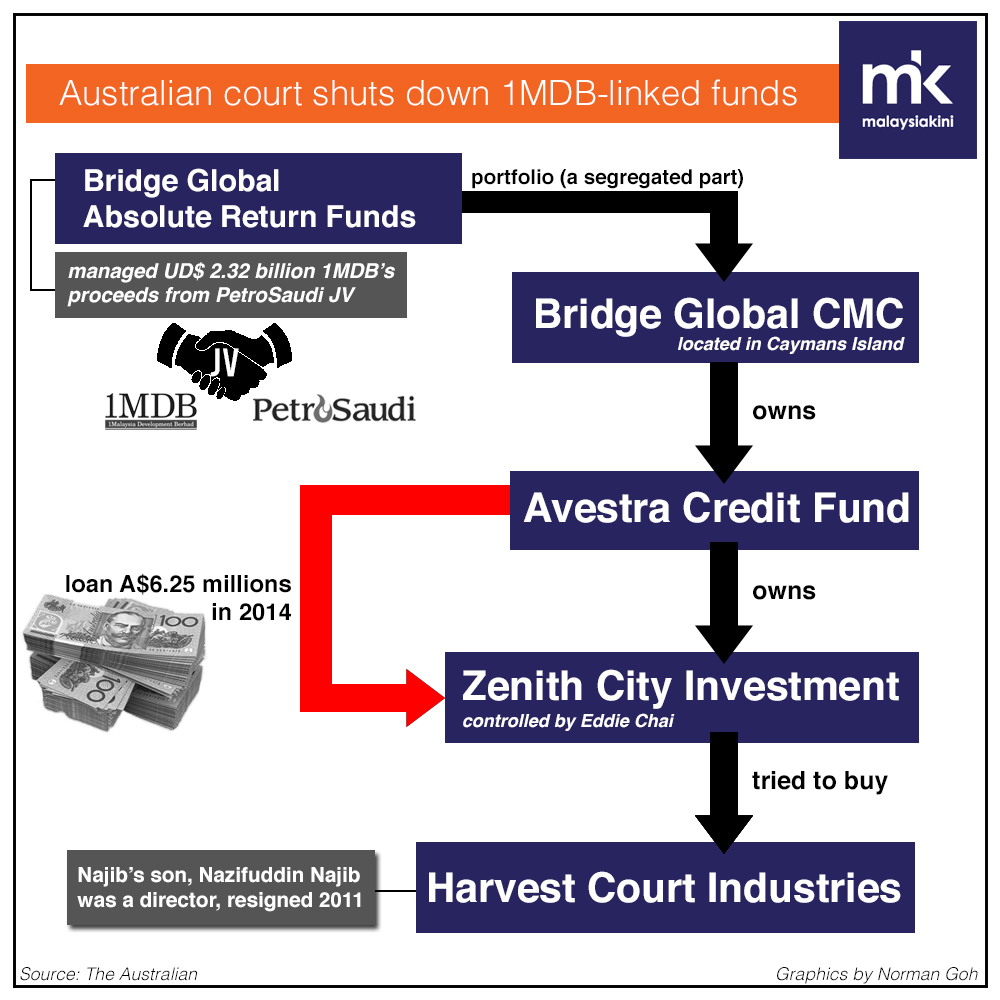

The Australian Federal Court shut down investment schemes run by 1MDB-linked Avestra Asset Management, The Australian newspaper reported.

Avestra, which was sued by investors who had suffered losses, is an entity of Bridge Global Absolute Return Funds.

1MDB earlier told The Wall Street Journal that Bridge Global managed its US$2.3 bil proceeds from the short-lived joint venture with PetroSaudi.

According The Australian , Avestra was found to have potentially breached corporate law after liquidators found undisclosed related-party transactions.

In documents submitted to the court, liquidators from Deloitte said Avestra failed to meet minimum cash and asset requirements, file audited accounts and ensure investments were properly made.

“There is no evidence to support a review of scheme assets to ensure compliance with the investment objectives, strategy, risk profile and other information disclosed in the scheme disclosure documents has occurred,” the auditors were quoted as saying.

Liquidators also found links between Avestra and Harvest Court Industries, where Prime Minister Najib Abdul Razak’s son Mohd Nazifuddin Najib was director until he resigned in 2011.

Liquidators said Avestra in 2014 loaned Zenith City Investment A$6.25 million, which was used in a bid to buy Harvest Court Industries.

Harvest Court was last year sued by Zenith, over board of directors members.

Investors who invested A$18.5 million in Avestra’s various schemes suffered dramatic losses in August.

The Australian Securities and Investments Commission (Asic) said Avestra sent A$5.6 million in cash and Malaysian stocks to Bridge Gllobal CMC before the collapse.

Related report