Malaysia is making steady advances in digital transformation, but a new study suggests the country still trails regional peers in terms of maturity.

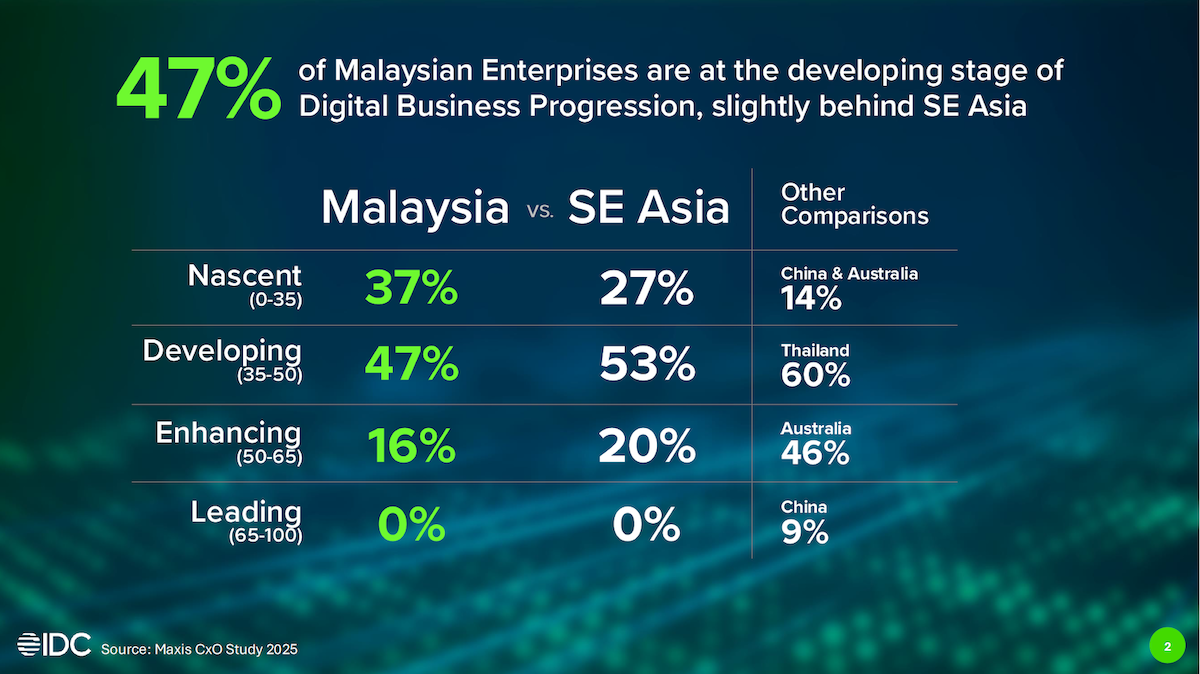

The IDC 2025 CEO Outlook study, conducted by IDC, a leading global market intelligence and advisory firm, and sponsored by Maxis Business – the B2B arm of integrated telecommunications provider Maxis – shows that 47 percent of Malaysian enterprises remain in the “developing” stage of digital maturity, a higher share than in Thailand and the Southeast Asian average.

The findings underline both progress and persistent challenges. While digital tools and platforms are now widespread, the report warns that the pace of adoption and integration must accelerate if Malaysia is to compete with neighbours that are already moving ahead with AI-driven growth strategies.

Four stages of maturity

IDC provides a detailed maturity framework to benchmark digital progress across industries and regions. The framework divides enterprises into four categories: nascent, developing, enhancing and leading.

Nascent organisations are at the very beginning of their journeys, where digital technology is used only in isolated parts of the business. Developing enterprises have adopted more broadly but are still focused on inward-looking goals, such as cost efficiency and process automation. Enhancing companies have begun using digital tools to create new value, often through AI and data-led initiatives. Leading organisations operate at the highest level of maturity, using digital transformation to drive growth, innovation and reinvention.

In Malaysia, 47 percent of enterprises fall into the developing stage, compared with 53 percent across Southeast Asia and 60 percent in Thailand. IDC noted that this imbalance reflects a tendency among Malaysian firms to prioritise efficiency over innovation, while regional peers have moved faster to adopt AI and data-driven models for growth.

Barriers to progress

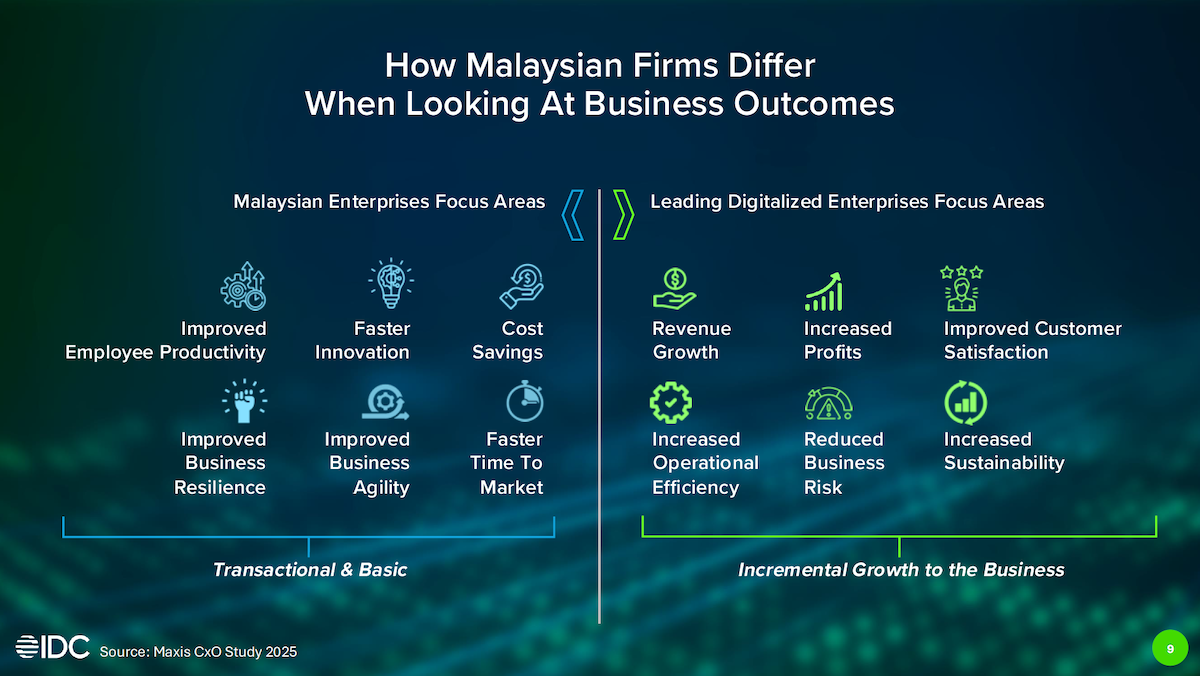

The study identifies several obstacles slowing Malaysia’s progress. Leadership priorities remain a central issue, with many CEOs still treating digital transformation as a tool for operational resilience rather than as a driver of new revenue.

Technology infrastructure also constrains advancement. Many organisations continue to rely on legacy systems, while IT spending has been limited compared with peers in the region. At the same time, skills shortages in AI and data analytics have made it difficult for enterprises to fully exploit new technologies.

IDC pointed out that although Malaysian businesses generate large volumes of data, much of it is not systematically applied in decision-making.

The report described this as a key weakness: data is available, but the ability to translate it into meaningful insights remains underdeveloped. A cautious corporate culture has also limited experimentation with new business models, further slowing the shift from developing to enhancing.

How leaders differ

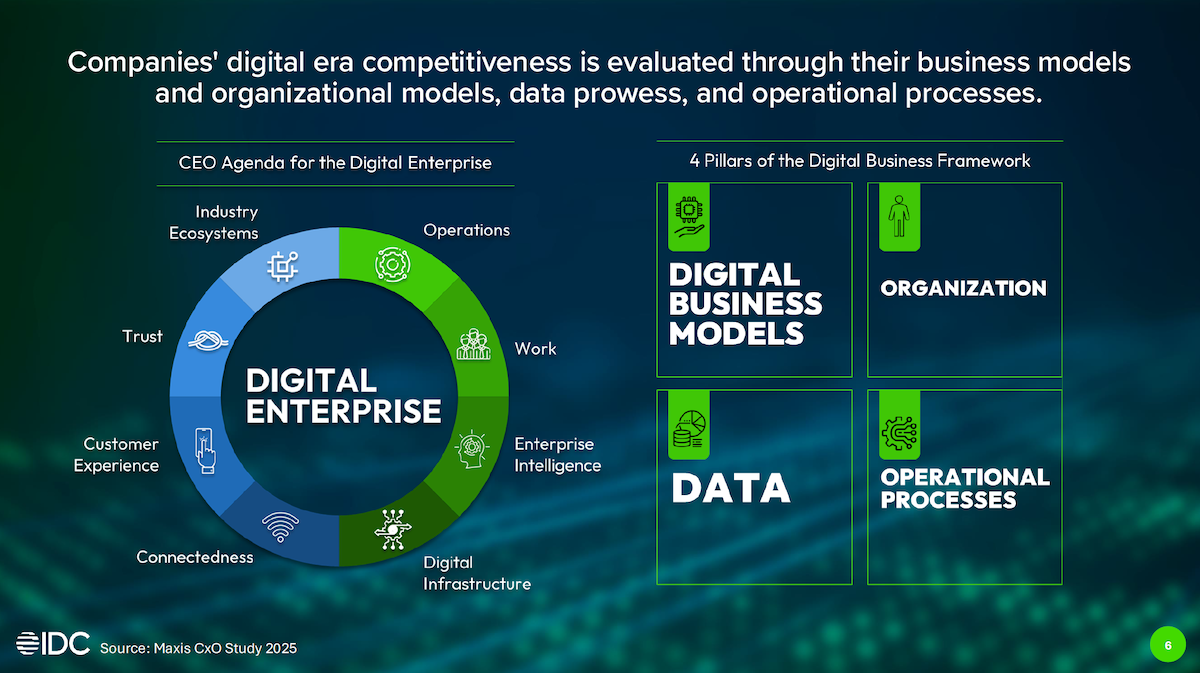

The report contrasted this with the practices of digital leaders worldwide. These organisations are distinguished not just by their use of technology, but by how they integrate it into their overall strategy and culture.

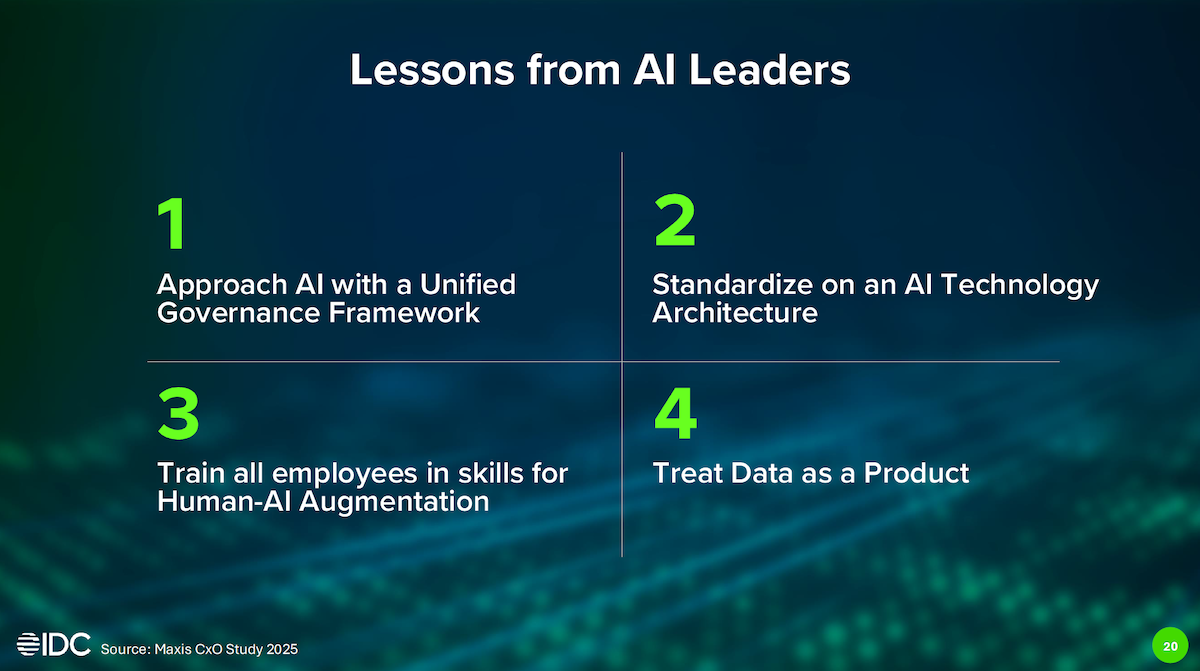

A defining characteristic is their focus on people. Leaders invest heavily in workforce reskilling, ensuring employees can adapt to new tools and work alongside AI systems.

IDC noted that in markets where enterprises are more advanced, training budgets for digital skills are often double those seen in developing-stage organisations. This focus on talent enables them to move faster when new technologies emerge.

Customer experience is another priority. Rather than limiting digital transformation to back-end efficiency, leading companies embed customer-centric approaches throughout operations, using data to anticipate needs, personalise interactions, and build long-term loyalty. AI is not treated as a side project but as a central pillar of innovation, embedded into products, services and decision-making processes.

IDC highlighted examples from multiple industries. Retailers are using AI to forecast demand and personalise shopping experiences in real time. Logistics firms are deploying predictive analytics and IoT devices to optimise routes, reduce costs and minimise delays. Banks are modelling customer behaviour to design entirely new services, from personalised credit products to predictive investment advice. In each case, AI and data are not experimental add-ons, but essential to how these enterprises compete and grow.

The road ahead

For Malaysia, the path to progress involves more than adopting new technology. The study stressed the importance of leadership vision and strategy. Enterprises that recognise digital transformation as central to growth are more likely to modernise infrastructure, invest in cloud and AI platforms, and develop cultures where decisions are guided by insights rather than intuition.

IDC recommended that Malaysian companies focus on three immediate shifts: strengthen digital leadership at the board level, allocate higher budgets to technology and skills, and accelerate the transition from efficiency-driven projects to growth-oriented innovation. Regional comparisons suggest that these actions make a measurable difference in maturity outcomes.

Partnerships are also emphasised as critical. The report noted that collaboration across ecosystems, including technology providers, regulators and industry peers, will be essential for Malaysia to close the maturity gap. Without such steps, the risk is that businesses will remain stuck in the developing stage while competitors in the region continue to move ahead.

A decisive moment

In its concluding analysis, IDC emphasised that Malaysia’s digital journey has reached a pivotal point. Progress has been made, but the country’s digital ambitions cannot be realised without bold moves that shift enterprises from developing to enhancing and leading. The report stressed that those who adopt AI and embed data-driven practices will not only close the maturity gap, but also play a defining role in shaping Malaysia’s future digital economy.

Learn more about Maxis Business' AI-fuelled business transformation.

Coming soon: “Building Tomorrow’s Business Today” series brought to you by Maxis Business

Catch the upcoming series for in-depth discussions on the insights behind the IDC 2025 CEO Outlook Report, commissioned by Maxis Business, the enterprise solutions arm of telecommunications provider Maxis. Produced in collaboration with IDC, a leading provider of global IT research and advice, the series explores what these findings mean for Malaysian businesses today.