COMMENT | The Penang government’s plan to reclaim Island A, the first part of Penang South Reclamation (PSR), seems like a fait accompli.

But how did we get here? Following the progress of the Penang Transport Master Plan (PTMP) might show that a sweet promise made to the public for a self-financing project, has been used to sell a questionable privatisation-cum-marketisation deal.

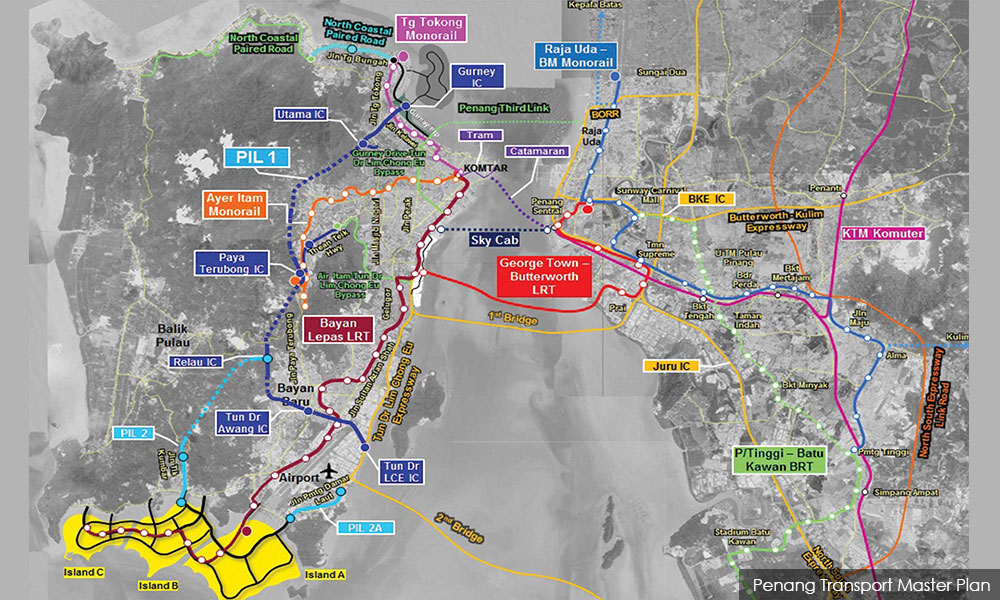

In early 2013, the Penang government approved a RM27 billion Penang Transport Master Plan (PTMP) to address the state’s transport and traffic problems. Two years later, the SRS Consortium proposed an amended PTMP which ballooned the costs to RM46 billion.

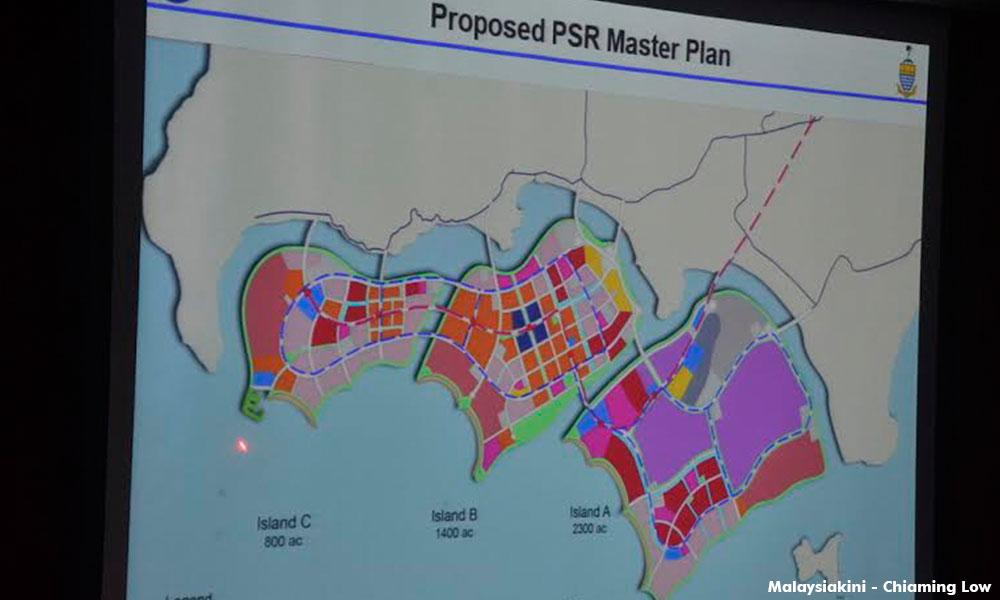

The proposal included the reclamation of three islands (4,500 acres) off the southern shores of Penang to finance the PTMP.

SRS Consortium was appointed to be the project delivery partner (PDP) to manage this massive project, charging a fee equivalent to six percent of the total project cost. SRS sold this PSR proposal to the state government as self-financed, that is, the proceeds of land sale will pay for the PTMP projects.

According to the SRS request for proposal (Volume 1, Chapter 4), reclamation of islands A and B, taking about eight years, will net an income of RM16.1 billion for the state (RM7.2 billion from Island A and RM8.9 billion from island B).

Volume 1 (pages 1-06) of the same proposal states that the PTMP project, “does not require the state (or the federal government) to raise or guarantee any loans to finance the delivery of the TMP (Transport Master Plan)”.

All funding, except the initial capital, is supposed to come from the reclamation of the three islands. SRS promised to source the initial RM1.3 billion bridge loan to kick start the reclamation. But this promise was never fulfilled.

Instead, the Penang government had to desperately approach multiple sources, including a Japanese government agency, to help finance the PTMP. When Pakatan Harapan became the federal government, the Penang government asked the latter to provide a loan or loan guarantee for up to RM10 billion.

By right, the state government should have rescinded its agreement with SRS since the latter could not fulfil its basic commitment, something which Penang Forum consistently advocated.

Eight years later, the people of Penang are sold a different story.

On March 25, 2021, Penang Chief Minister Chow Kon Yeow revealed that Island A, the largest island to be reclaimed, will become “private”. This is because the Penang government was unable to secure a loan or financial support from the federal government to jump-start the mega-project.

Gamuda in driver's seat

Under the new public-private arrangement, a 30-70 joint-venture called the Project Developer (PD) would be set up - 30 percent owned by a PSG (Penang state government) nominee and 70 percent by SRS. The PD has sole and exclusive rights to develop and sell the reclaimed land in Island A. The PD in turn would award all construction work (not through open tender) to a turnkey contractor (TC), another 30-70 joint venture between a PSG nominee and SRS, to manage and implement the project.

The TC will directly award the reclamation work to Gamuda Engineering and other work packages (infrastructure work, PIL2A and Phase 2 reclamation) via competitive bidding. Upon completion, Island A will be handed over to the PD who will in turn call for tender on land parcel sales. This new scheme puts Gamuda in the driver’s seat as it owns 70 percent of the joint venture through SRS.

Gamuda will be responsible for financing the project and the PSG will be absolved from all financing responsibility and risks.

The PD will have full control over the reclamation schedule – reclaiming and selling according to market conditions, stipulating that the condition that the work should be completed within 10 years from work commencement.

It is expected the reclamation will take up to six years with initial land sales beginning from year four. This means the original intention of financing PTMP projects based on land sale is no longer applicable, for the link between land sale and PTMP project construction has been broken. Land reclamation and sale are driven purely by market conditions, not by PTMP projects.

According to the chief minister, the Penang government doesn’t have to fork out a cent and it will still own all the reclaimed land. This deal sounds too good to be true.

So, what will the Penang government get out of this new arrangement? The short answer is RM600 million in seven to 10 years’ time. It is even less (about RM400 plus million) on present value basis.

Let us follow the arithmetic of this new deal. According to Gamuda’s new estimates, land sale proceeds from Phase 1 of Island A are between RM8 billion and RM9 billion over seven years, reclamation costs are between RM4 billion and RM5 billion, and construction costs between RM2 billion and RM2.5 billion. (The reclamation and infrastructure costs have more than doubled compared to the SRS 2015 proposal.) Taking the higher estimates, the net revenue is estimated at RM2 billion (RM9 billion less RM7 billion). Hence, the net revenue for the Penang state government is RM600 million (30 percent of RM2 billion).

If the Penang government gets only RM600 million from this new deal, what will Gamuda stand to gain? Plenty. It has complete monopoly over all reclamation work. All proceeds from the land sale shall be used to pay for all the PD’s and TC’s costs and liabilities, including but not limited to payment to the TC, payment of interests and loan principal, all fees, and taxes. In other words, Gamuda would be “double-dipping” - by making good profit from the reclamation work and, on top of that, chalking up 70 percent of net proceeds of the PD and the TC.

Will PSR deliver its promises?

The original idea and intention of the PSR project were to fund the RM46 billion PTMP. The initial estimated costs of the PIL1 and LRT (the first two PTMP projects) came to about RM6 billion each. These costs have ballooned to about RM8 billion for each.

Penang Forum is in principle against the PIL1 and LRT because these mega projects are overdesigned for local population needs, too costly, and entail unacceptable environmental impacts. However, for the purposes of this essay, there is a need to analyse whether the PSR will deliver what the government promised.

Is the Penang government admitting that the LRT and PIL1 will not start until they are able to get money from the reclaimed land sale in seven to 10 years’ time? Even then, how is a projected revenue of RM600 million from Island A going to pay for the LRT and PIL1 which will cost RM8 billion each?

What can we conclude from all the twists and turns in the agreements between the PSG and SRS/Gamuda?

Financing a bloated PTMP was put forward as the original justification for the PSR project. But it is now clear this has failed. It is impossible to finance even the two initial projects of the PTMP (LRT and PIL1) with RM600 million. PTMP and PSR have been decoupled. Perhaps the PTMP was simply a bait for the people of Penang, which has now switched to the original intention of land reclamation for land sales per se and nothing further.

In the face of the pandemic, the economic forecast for the next 10 years is uncertain. What happens if the cash flow starts to falter before land sales can begin? Will Island A end up like so many other stalled reclamations? The Penang government is willing to gamble away the state’s fortunes given unforeseeable externalities that will have to be borne by future generations.

In this whole process, Penang loses its environment, valuable fishing ground, food security, and loss of fishermen's livelihood, etc. SRS’s consultants in its Environment Impact Assessment (EIA) admitted that the PSR project will result in “irreversible change” to the environment and a “permanent loss” of physical and biological resources in the seas of southern Penang island.

This new arrangement clearly does not make any economic, financial, and ecological sense. It is against all public interests and is a folly to continue.

LIM MAH HUI is a former professor, banker, and Penang city councillor.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.