Malaysia is implementing a nationwide e-invoicing system, known as MyInvois, which will significantly transform how businesses document and report their transactions.

This transition presents challenges and opportunities for retailers dealing with high volumes of low-value transactions.

This guide provides practical strategies for complying with Malaysia's e-Invoice requirements while minimising operational disruption.

Understanding Malaysia's e-Invoice Requirements

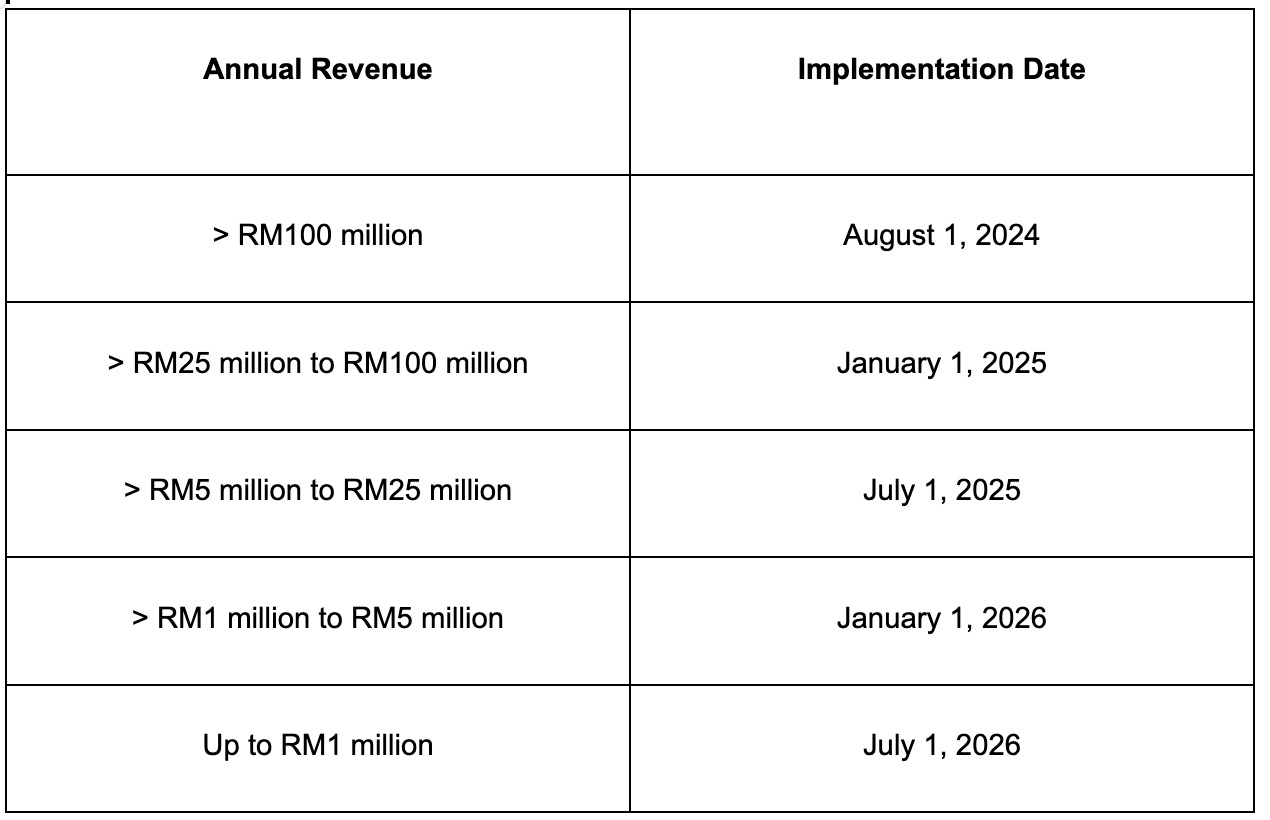

The e-Invoice implementation in Malaysia follows a phased approach based on annual revenue:

Businesses with an annual revenue of below RM500,000 are generally temporarily exempt.

Key Requirements for Retailers

1. Individual vs. Consolidated e-Invoices:

When customers request an e-Invoice at the point of sale, retailers must collect the required customer details and issue an individual e-Invoice.

For transactions where customers don't request e-Invoices, retailers can submit consolidated e-Invoices to LHDN monthly (within 7 days after month-end).

2. System Requirements:

Maximum size of 5MB per submission

Maximum of 100 e-Invoices per submission

Maximum size of 300KB per e-Invoice

3. Submission Methods:

MyInvois Portal (web-based)

API integration with existing POS/ERP systems

Practical Strategies for Retail Implementation

1. Assess Your Transaction Volume and Pattern

Before implementing any solution, analyse your:

Average daily transaction count

Peak period transaction volumes

Percentage of customers likely to request e-Invoices

Current receipt numbering system

2. Choose the Right Submission Approach

For Small Retailers (< 100 transactions daily)

The MyInvois Portal may be sufficient

Use the batch upload functionality for consolidated e-Invoices

Create individual e-Invoices on demand when customers request them

For Medium to Large Retailers

API integration with your POS system is recommended

Consider working with technology providers who offer ready solutions

Ensure your POS system can collect customer details efficiently when needed

3. Managing Consolidated e-Invoices

For transactions where customers don't request e-Invoices (typically the majority in retail):

Organise Your Receipt Data:

LHDN allows three methods for consolidated e-Invoices:

Present each receipt as a separate line item

List receipts in continuous receipt number chains

Submit by branch/location using either of the above methods

Develop a Month-End Process:

Extract relevant receipt data from your POS system

Format according to e-Invoice requirements

Submit within 7 days after the month-end

Split into multiple submissions if exceeding size limits

4. Managing Customer Requests for e-Invoices

When customers request e-Invoices:

a) At Point of Sale:

Collect mandatory customer details:

- Name

- Address

- Contact number

- Either TIN or MyKad/MyTentera number (for Malaysian individuals)

- Either TIN or TIN with passport/MyPR/MyKAS number (for non-Malaysian individuals)

- Submit an e-Invoice for validation

- Share a validated e-Invoice with the customer

b) After Transaction (but within the same month):Implement a system for customers to request e-Invoices after purchase

Options include: Web portal, Mobile app, Customer service counter.

The process must verify purchase details and collect required customer information

5. Technology Solutions to Consider

POS System Upgrades:

Work with your current POS provider to add e-Invoice functionality

Ensure integration with LHDN's API specifications

Add fields to capture customer details when needed

POS systems such as AutoCount POS 4.0 come with built-in e-Invoice features, allowing users to effortlessly submit consolidated e-Invoices to LHDN .

Middleware Solutions:

Consider specialised e-Invoice middleware that sits between your POS and LHDN.

Can handle receipt data aggregation and conversion to required formats

Manages submission scheduling and error handling

Customer-Facing Options:

Self-service terminals for e-Invoice requests

QR codes on receipts linking to an e-Invoice request

Mobile app functionality for registered customers

Implementation Checklist

✅ Determine your implementation deadline based on annual revenue

✅ Map your current receipt/invoice processes

✅ Choose between MyInvois Portal or API integration

✅ Train staff on collecting customer information when e-Invoices are requested

✅ Develop processes for consolidated e-Invoice preparation and submission

✅ Implement customer-facing solutions for post-purchase e-Invoice requests

✅ Test your solution before the mandatory implementation date

✅ Prepare for record-keeping of both e-Invoices and traditional receipts during the transition

Common Challenges and Solutions

Challenge 1: Customer Wait Times for e-Invoice Requests

Solution: Implement a phased capture approach where basic transaction details are processed first, allowing the customer to leave while detailed information is processed later.

Challenge 2: High Volume During Peak Periods

Solution: Consider a hybrid approach – collect customer information during peak times but process e-Invoice submissions during quieter periods (still within the same day).

Challenge 3: Multiple Store Locations

Solution: Each store can manage its own consolidated e-Invoices or implement a centralised system with branch identification.

Challenge 4: System Integration Costs

Solution: For immediate compliance, start with the MyInvois Portal while planning a phased integration with your POS/ERP systems.

The transition to e-invoicing represents a significant change for Malaysian retailers, but with proper planning and implementation strategies, businesses can minimise disruption while gaining benefits from increased digitalisation.

By understanding the specific requirements and leveraging appropriate technology solutions, retailers can establish efficient processes for managing both individual and consolidated e-Invoices.

For the latest information and updates, retailers should regularly consult LHDN's official resources and consider working with tax professionals and technology providers specialising in e-Invoice implementation.

About the Author

Mr. Chin Chee Seng is the Independent Non-Executive Director of AutoCount and the Founder of CCS Group.

This e-Invoice News series is a collaboration with AutoCount.