LETTER | I just would like to put into context the recent complaints about big increases in medical insurance premiums based on my own experience.

I have had a medical insurance policy since 2007 and have not made a single claim on the policy since its inception. I am now 59 years old.

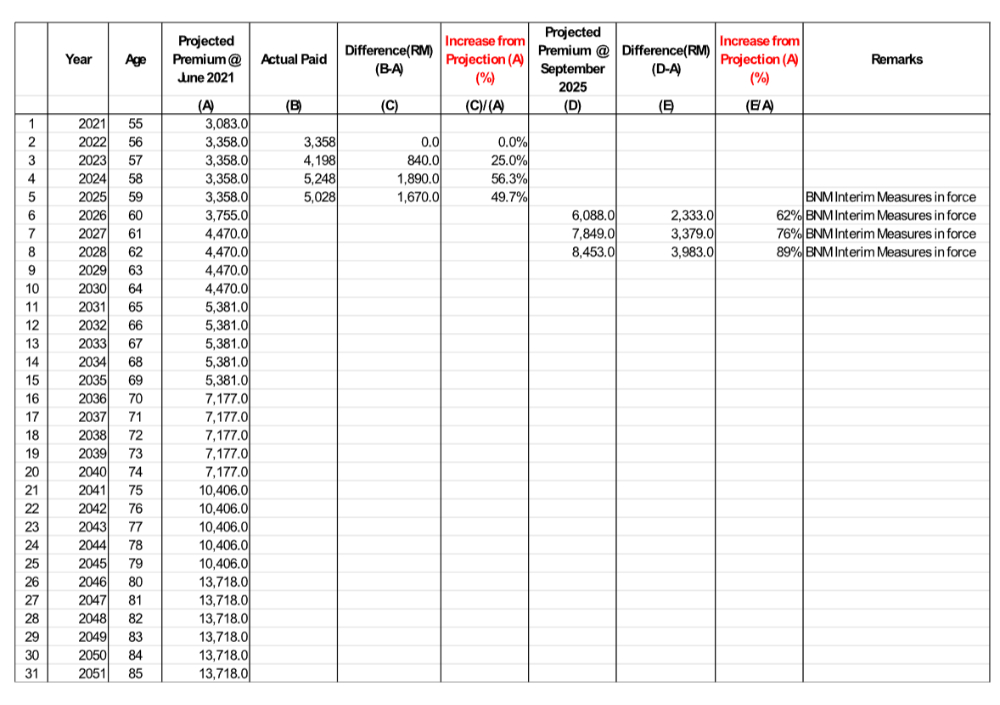

Throughout my analysis, I will use a revision the insurer made to the premiums in June 2021 as the benchmark against which I compare the numerous adjustments the insurer made, as shown in the table below:

I believe that using the June 2021 adjustment as the benchmark is appropriate because this adjustment is recent and would reflect the changes in hospital charges and policyholders’ claim behaviour during the relevant period. The analysis is given below:

The June 2021 adjustment

As shown in Column A, in 2021, the insurer indicated the premium to be paid by me in 2021 and the projected annual premium to be paid by me until 2051, when I turn 85.

In 2022, the insurer honoured the projected premium and billed me accordingly (see cell B2).

However, for the 2023 premium, they increased my premium to RM4,198 (see cell B3), a 25 percent increase from the premium projected in 2021, barely two years ago.

In 2024, the premium was further increased to RM5,248 (see cell B4), a 56.3 percent increase from their 2021 projection.

September 2025 adjustment - Bank Negara steps in

Following the recent public outcry following the huge increases in medical insurance policy premiums in 2024, Bank Negara Malaysia (BNM) intervened, and the insurer came out with an interim revised measure in September 2025 (see cell B5 and column D)

In this revision, the insurer charged a premium of RM5,028 (see cell B5) for 2025 and projected an increase to 2028 as shown in column D.

Note that there is a slight drop in the 2025 premium charged against the 2024 premium paid following the interim measure, but a significant increase for 2026 to 2028, even though it is “in compliance” with the BNM interim measure.

My issues

As Insurance companies hire an army of actuarists to do their analysis, together with their vast experience in the industry, it is inconceivable that their projection can go wrong so badly after only two years of being made in 2021 (ie insurer abandoned their own projection from 2023 onwards).

If you look at Column A, the annual premium is supposed to hold steady for ages 56 to 59; however, this has not been honoured since age 57.

But the most curious and shocking change to consumers in the BNM interim measures is that the annual premium from 2025 to 2028 is based on the significantly higher base of 2024.

So, despite the interim measure, you can see that the projected premiums in 2026-2028 are still 62-89 percent higher than their projections made in 2021.

The impression given is that the premium increase is “in compliance” with BNM’s interim measures, where, in fact, the base ignores their own projections made in 2021.

Based on the insurer’s projected premium via their interim measure letter in September 2025, in 2027 (cell D7), I would be paying the premium that I would have had to pay in 2036 as projected in 2021 (cell A16).

The 2036 premium has been brought forward by nine years! And my 2028 premium now (cell D8) has exceeded the 2036-2040 (Cells A16-20) by 18 percent!

Suggestions for BNM

BNM must investigate the commercial rationale for the big increase in premiums in 2024 and decide whether there is justification to implement the interim measures for premiums in 2025 to 2028 and beyond based on the 2024 premium.

I would argue that a fairer base for the interim measure calculation would be the 2022 or 2023 premium, not 2024, due to the significant increase in the 2024 premium.

We appreciate the fact that in 2020-2022, the world was hit by the Covid-19 pandemic and that overall medical costs for society and therefore claims against insurers went up during that period.

However, I hope that BNM will be vigilant to ensure that the costs of a once-in-a-100-year event are not being treated as an annual event to justify astronomical premium increases.

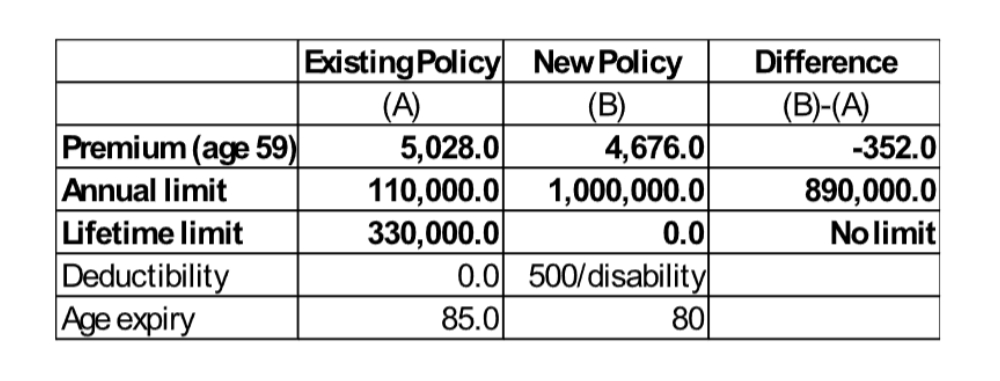

What is even more puzzling, with the September 2025 revised projected premium on my existing policy, I am now paying a higher premium than if I were to buy a new insurance from the same company with much larger coverage.

There may be differences between the coverage for both the old and new policies. However, for the public, it is very difficult for them to work out the pros and cons of each policy other than to note that there is a huge difference in annual claim limits at a lower premium.

I believe BNM must set a cap on annual premiums against one’s annual claimable limit.

Based on my existing policy as revised by the September 2025 interim measure (column D), by the time I reach 62, I am projected to pay a premium of RM8,453 (cell D8) or 7.7 percent of my annual claimable limit of RM110,000.

However, if I buy a new standalone medical insurance by the same insurer with an annual limit of RM1 million, the projected annual premium I am supposed to pay at the age of 62 is RM6,864.

If you set this against the annual claim limit of RM1 million, the annual premium of the new policy amounts to about 0.6864 percent of the annual limit vs 7.7 percent of my existing policy.

Is there a clever plan by the insurer to force all existing policyholders to give up their existing policy, as the terms are more generous to the policyholders?

BNM also needs to monitor the type of coverage that the insurer offers as a “top-up” to one’s existing policy. I notice this kind of “top-up” policy tends to have a very large annual limit (RM1.5 million to as high as RM5 million per annum).

While there may be cases where a certain illness will incur a large medical bill, we need to ask whether it is fair to impose this kind of large annual limit (and hence large premium) as the only option for “top-up”.

It runs a big risk of “over insurance”, and when such a large premium is applied to a very large policyholder pool, the profit for the insurer can be very substantial.

Lastly, I hope BNM can ensure insurers continue to provide the projected premium table during the lifetime of the policy and check on them regularly. I believe that with the advancement of artificial intelligence, this can be done easily.

While I accept that these projections are subject to change, this is at least a way to ensure accountability by the insurer and ensure that they do not increase the premium arbitrarily.

This will also enhance transparency to the policyholders so they know if they can afford the policy upfront as unlike a life insurance product, where the premium paid will be crystallised as a lump sum payment back to the policyholder or their beneficiary in the event of death or certain illness, a medical insurance premium is just an expense to the policyholder.

We look to insurance to help us meet our medical costs. However, with the way premiums are increasing, I foresee many abandoning their policies and falling back to the public healthcare system as the only option available to them.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.