Urban Wellbeing, Housing and Local Government Minister Noh Omar's proposal to allow property developers to grant loans can worsen the rising household debt in Malaysia, ratings agency Fitch Ratings says.

"(It) could add to the risks associated with rising household debt.

"The scheme is likely to encourage unregulated lending to households with weak financial profiles, and could undermine the strength of the financial system if not implemented prudently," Fitch Ratings said in a report on its website yesterday.

Noh announced last Thursday that developers could now apply for a money lending licence to provide loans to house buyers.

He had said the interest rate of the loan would be capped at 12 percent with collateral, or up to 18 percent without collateral.

The cabinet yesterday told him to study this proposal further.

The Finance Ministry has previously said that as at March this year, household debt stood at RM1.04 trillion, or 89 percent of the country’s gross domestic product (GDP).

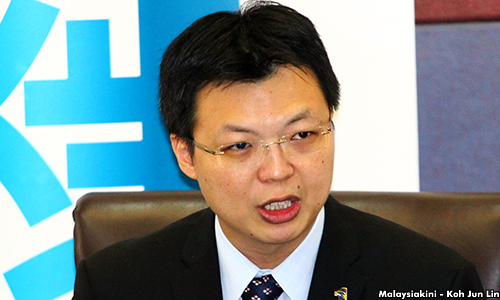

Then deputy finance minister Chua Tee Yong (photo) told Parliament in May that 80 percent of the debt is from banking institutions.

Then deputy finance minister Chua Tee Yong (photo) told Parliament in May that 80 percent of the debt is from banking institutions.

"Those earning less than RM3,000 per month have a debt equivalent of around seven times their annual income, compared with three times among higher-income households.

"It is precisely those households with weaker financial profiles and poor access to bank loans that are likely to be targeted by developers," Fitch Ratings said.

This, it said, would especially be a problem as loans from property developers would not fall under Bank Negara's oversight, and would run counter to the central bank's efforts to curb the rise in household debt.

These efforts, the agency said, have been successful, with household debt growth easing from a peak of 16.8 percent in 2011 to just 7.3 percent in 2015.

Fitch said larger developers would likely be more cautious in handing out loans as they would have a hard time assessing the creditworthiness of borrowers. Plus, their businesses are already profitable.

"However, weaker developers could be tempted to lend in order to ramp up property sales."

Noh had defended his plan as being an alternative means for the people to obtain loans to buy low-cost housing.

However, critics of the plan said the problem was not that people could not obtain loans, but that affordable housing was not affordable.

Meanwhile Second Finance Minister Johari Abdul Ghani pointed out that if house buyers could not obtain loans from banks at an interest rate of between four and six percent, it was not logical to expect them to be able to cope with a loan that imposes an interest of up to 18 percent.