Malaysia’s fundamentals remain strong and resilient with its economic growth projected to expand between 5.5 percent and 6.0 percent this year, said Bank Negara governor Muhammad Ibrahim.

Last year, the domestic economy grew strongly by 5.9 percent, supported by the global growth upswing and robust domestic demand.

“Given the continued strong performance, the Malaysian economy is on track to register growth in the upper end of the projected range or even could exceed beyond six percent this year,” he told senior editors at a briefing ahead of the release of the central bank's 2017 annual report and the financial stability and payment systems report today.

The projection figures was based on the back of improving global fundamentals and higher crude oil prices with Brent spot prices to average about US$62 per barrel in both 2018 and 2019, compared with an average of US$54 per barrel in 2017, he said.

For 2018, Muhammad (photo) stated that domestic demand would continue to be the anchor of growth, underpinned by private sector activity.

“Private consumption growth is expected to remain sustained, supported by continued growth in employment and income, lower inflation and improving sentiments,” he said.

The income growth would be supported by a robust export performance and continued government measures, such as the continuation of BR1M cash transfers, individual income tax reduction and the special payment to all civil servants and retirees.

Meanwhile, private investment growth will also be sustained, underpinned by ongoing and new capital spending in both the manufacturing and services sectors, and strengthened by continued positive business sentiments.

Public sector expenditure is projected to decline due to the contraction in public investment amid more moderate growth in public consumption.

Apart from domestic demand, GDP growth will also be supported by the favourable external demand conditions. Both gross exports and imports are forecast to grow at above-average trends in 2018.

Exports will be lifted by favourable demand from major trading partners, the continued expansion in the global technology upcycle, increase in domestic productive capacity and broadly sustained global commodity prices.

Touching on headline inflation, Muhammad said it was projected to moderate in 2018, averaging between 2 percent and 3 percent.

“The lower inflation compared to 2017 is due mainly to an expected smaller contribution from global energy and commodity prices. A stronger ringgit exchange rate compared with 2017 would also mitigate import costs,” he said.

Inflationary pressure from domestic demand factors will be contained by improving labour productivity and ongoing investments for capacity expansion.

However, the inflation outlook, depends on the trajectory of global oil prices, which remains highly uncertain.

Overall, the governor said the economic outlook was marked by several upside risks to growth.

"This includes stronger than expected global demand, which in turn would improve the prospects for export-oriented industries.

“The potential increase in minimum wage and a faster-than-expected pickup of existing and new production facilities in various industries would also support a more favourable growth outlook,” he said.

Nevertheless, the bank said there were several downside risks to growth remain.

The strength of Malaysia’s exports to major trading partners could be impacted by unfavourable effects arising from monetary and regulatory policy shifts in the advanced economies, rising trade protectionism by major trading partners and a sharper than expected growth moderation in China.

In addition, a reemergence of volatile global commodity prices or abrupt corrections in the global financial markets could weigh down sentiments, which in turn could dampen the strength of domestic economic activity.

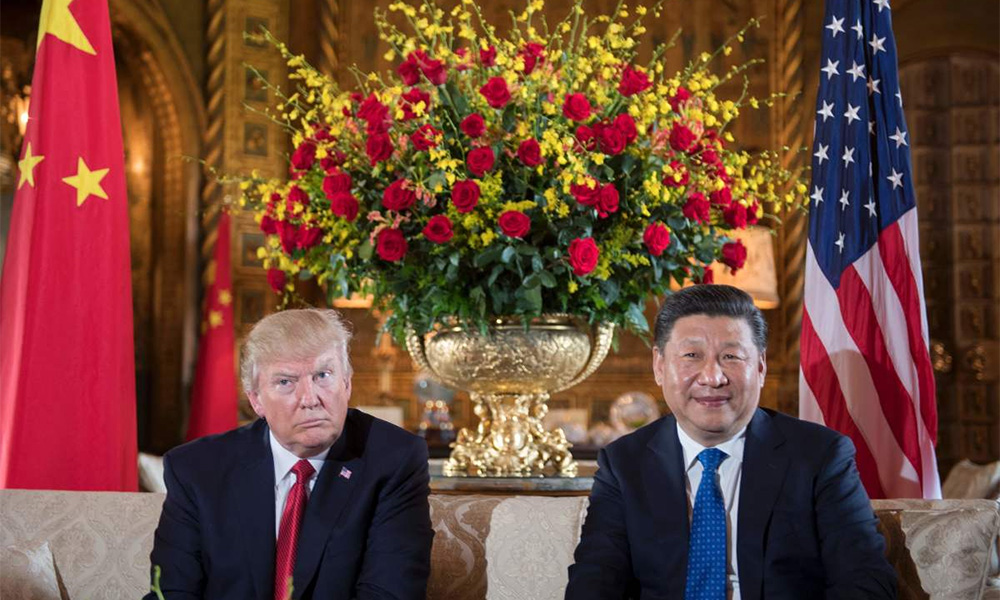

Muhammad later cited concern on the possible trade war between the United States and China which could pose a threat to the global economy including Malaysia.

"So, open trade does not benefit anybody. Everybody will lose from open trade. And, if that happens, that number (GDP projection) has to be relooked,” said Muhammad.

Last week, US President Donald Trump signed a presidential memorandum that could impose tariffs of up to US$60 billion (RM233.7 billion) on imports from China and restrictions aimed at preventing Chinese-controlled companies and funds from acquiring US firms with sensitive technologies.

At the briefing, the governor also touched briefly on several key issues including cryptocurrency, the GST, interest rates and cyber security.

On cryptocurrency, Muhammad said the central bank has issued a final draft related to it of which under the proposed policy, digital currency exchanges will be subject to the Anti-Money Laundering, Anti-. Terrorism Financing and Proceeds of Unlawful Activities Act 2001.

"It is not a good exchange between people. There is no consumer protection at all. It is more accurate if we call these currencies as crypto token, crypto asset or ‘crypto where you want to lose your money,’" he said with a smile, which drew laughter from the crowd attending the briefing.

However, he said banning the cryptocurrencies was not possible because it could curb innovation and creativity in the financial sector, particularly in financial technology.

- Bernama