The government will be reviewing the list of goods under the sales and service tax (SST) and amending the list by the end of the year.

Finance Minister Lim Guan Eng said the ministry would be obtaining feedback and views from the people on the list of goods and a study would be conducted on whether some goods should be taxed under SST or not.

"The full list has already been uploaded but we need to make amendments. As I have said that we need to impose SST on Sept 1. I have no choice, because we could be in a deficit if it was not implemented on Sept 1.

“After getting the views and requests of the people, we as the caring government will listen to the views and take the appropriate actions. So we will be making another round of amendments and I hope the people will be patient,” he told reporters after a briefing on the implementation of SST here today.

He said there were several food items which should not be taxed under SST as some goods were placed under the same group.

"The problem is all imported foodstuff such as seafood like abalone as well as prawns were lumped in the same group, so we have to make the amendment.

"That is why we may take out some items which ordinary people consume, and we will also study on whether to reduce or increase the rate,” he said.

Lim, who is Bagan MP, admitted there had been confusion over the implementation of SST by consumers who did not know the latest tax system.

As an example, he said there were complaints from consumers who ate at restaurants such as nasi kandar shops which imposed the service tax of six percent.

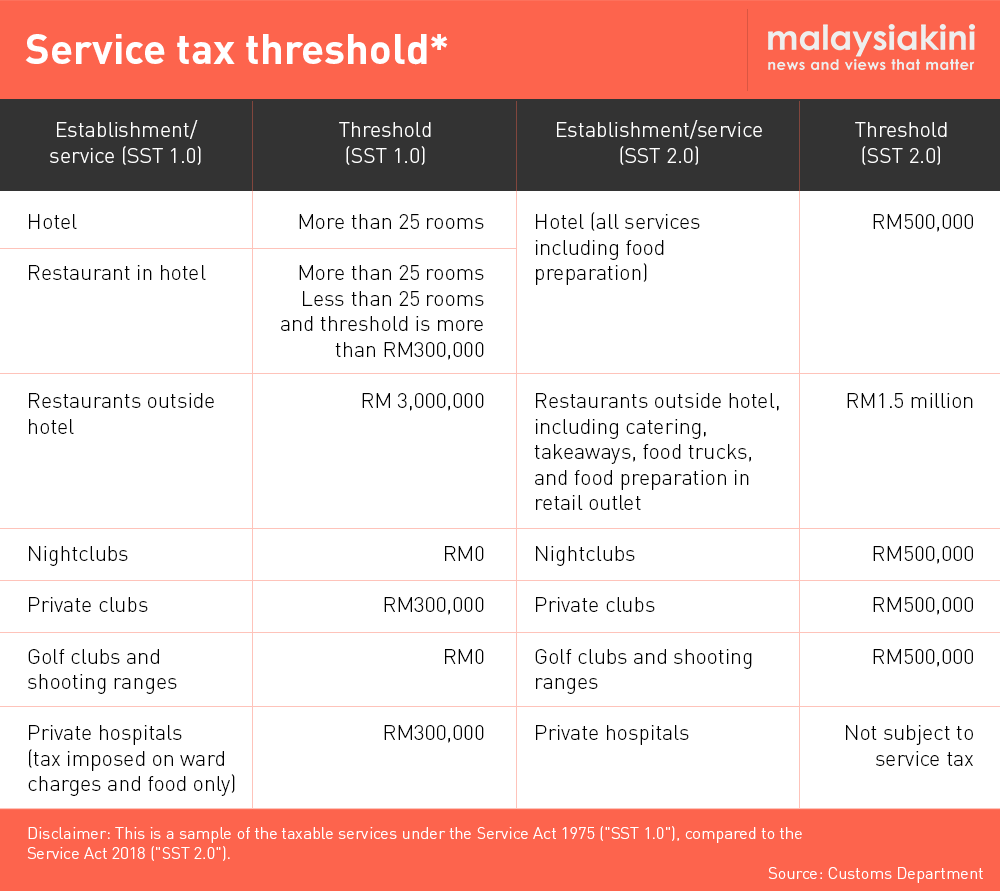

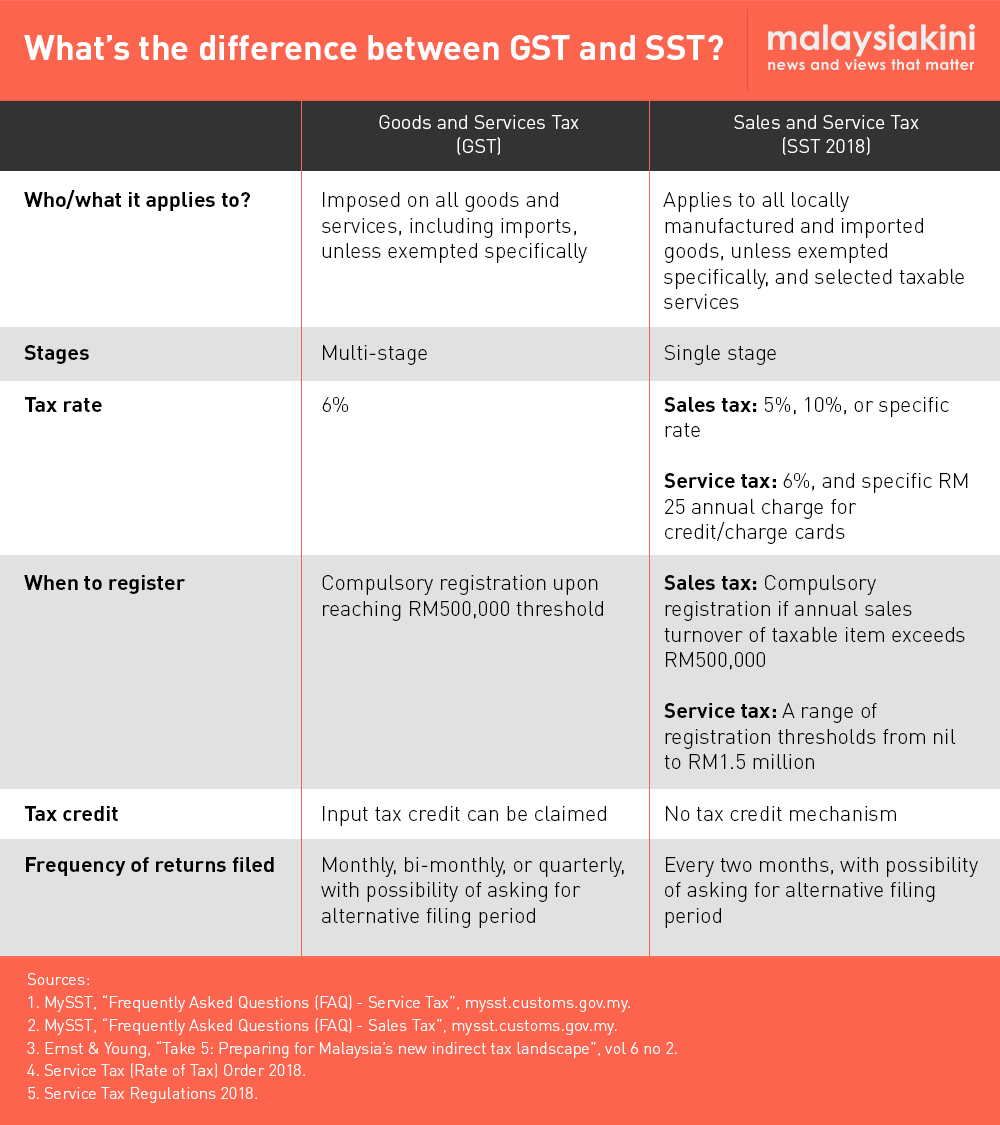

He said through implementation of SST, the government had increased the threshold for service tax to RM1.5 million compared to RM500,000 under the goods and services tax (GST) in which restaurants with sales exceeding the amount have to impose the six percent service tax.

"Here, I hope customers will understand why some restaurants do not need to collect and some do. Do not blame the restaurant owners as they are only carrying out their responsibilities as responsible businessmen who complied with the law.

"I also want to stress that service charge is not a tax. It is a collection for restaurant waiters and waitresses. In the past GST is charged on service charge but under SST we do not tax service charge, so I hope they understand,” he said.

In this regard, Lim assured prepaid card buyers that they would be receiving the full amount if they reload their prepaid mobile phone.

“We have issued the order that we want to ensure that a prepaid card for RM10 will be worth RM10. The six per cent service tax will be credited back as it is set in the service tax system.

“There should not be technical problems but if it happened, we will give rebate to the buyer for the same value. So do not be taken in by parties who are instigating that a RM10 prepaid card is worth less than RM10. It is not true,” he said.

- Bernama