Over US$4 million in 1MDB-linked funds were allegedly used by Riza Aziz and his business partner Joey McFarland to buy shares in a facilities management company in Kentucky, US.

Riza Aziz is the stepson of former prime minister Najib Abdul Razak.

The shares are among three 1MDB-linked assets that the US Department of Justice is seeking to seize in its latest round of civil forfeiture suits, which were filed on Friday in California.

According to the lawsuit, the pair bought a 43.37 percent stake in the firm, dubbed 'Company 1', in June 2013.

It is unclear why they had bought stakes in the firm. An unnamed executive dubbed 'Company 1 Executive 2' is allegedly friends with McFarland.

The US$4.2 million used for the buy-in was transferred directly from Red Granite Investment Holdings, a company wholly owned by Riza, to another executive dubbed 'Company 1 Executive 1'.

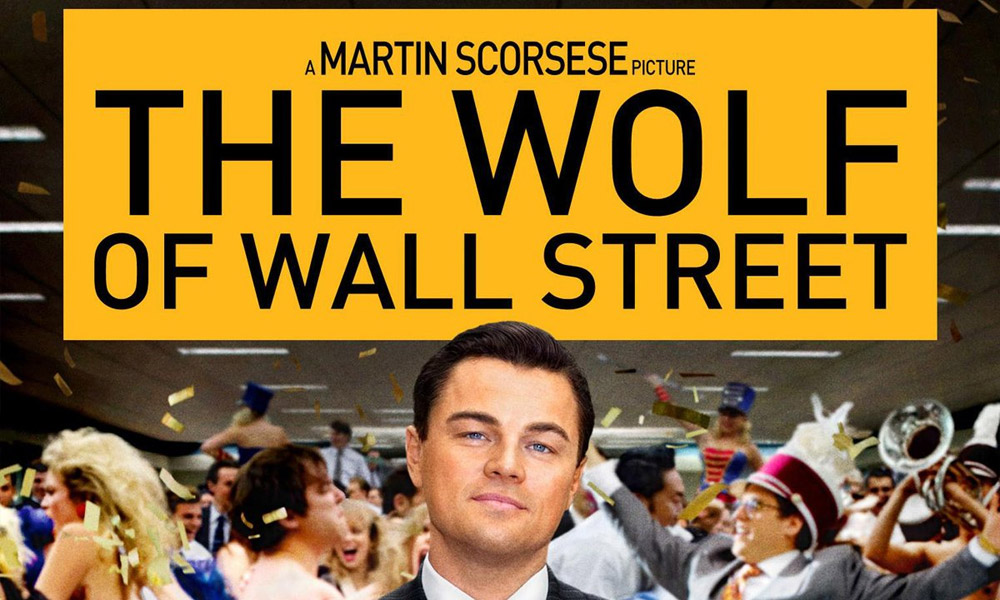

The money had been part of US$50 million loaned by Telina Holdings to Red Granite Capital, another Riza-owned firm, to finance the filming of the 2013 movi The Wolf of Wall Street.

Telina Holdings, a company registered in the British Virgin Islands, is owned by Khadem Abdulla al-Qubaisi, former managing director of the International Petroleum Investment Company.

According to the DOJ, The Wolf of Wall Street was used as collateral for the loan.

Read more: 'Stolen' 1MDB Funds: the DOJ lawsuit revisited

While Qubaisi is an alleged beneficiary of the 1MDB scandal, it is unclear how the funds from Telina are linked to 1MDB.

The department claimed that plans for the buy-in began in November 2012, and were hashed out over the following months.

In January 2015, 18 months after the buy-in, McFarland received a distribution of about US$3.5 million from 'Company 1'. McFarland later transferred US$1.5 million to Riza's personal accounts.

In January this year, 'Company 1' spent US$28.1 million to buy back the shares from Red Granite Investment Holdings and McFarland.

It did so through an affiliate firm, New FM Acquisition Company.

The funds were then placed in an escrow account held by law firm Squire Patton Boggs.

RELATED REPORTS