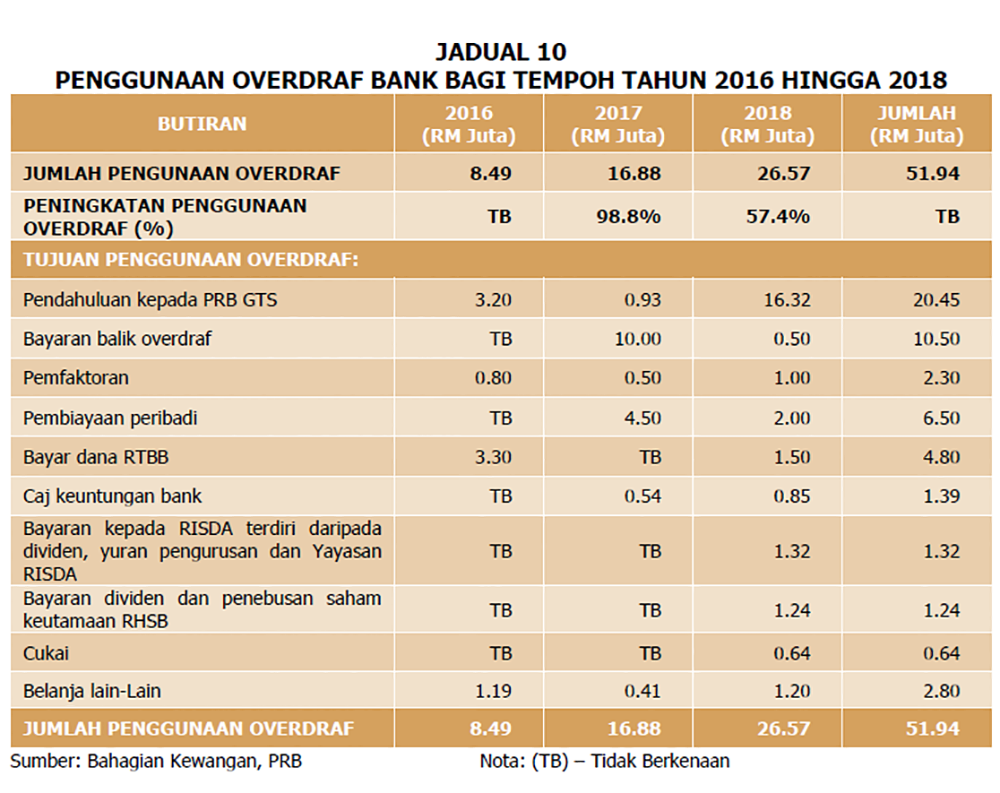

The investment arm of the Rubber Industry Smallholders Development Authority (Risda) made RM51.94 million in bank overdrafts to make ends meet between 2016 and 2018.

A report by the National Audit Department found that Permodalan Risda Berhad (PRB) used the overdrafts, among others, as an advance to a subsidiary, and even to repay previous overdraft transactions.

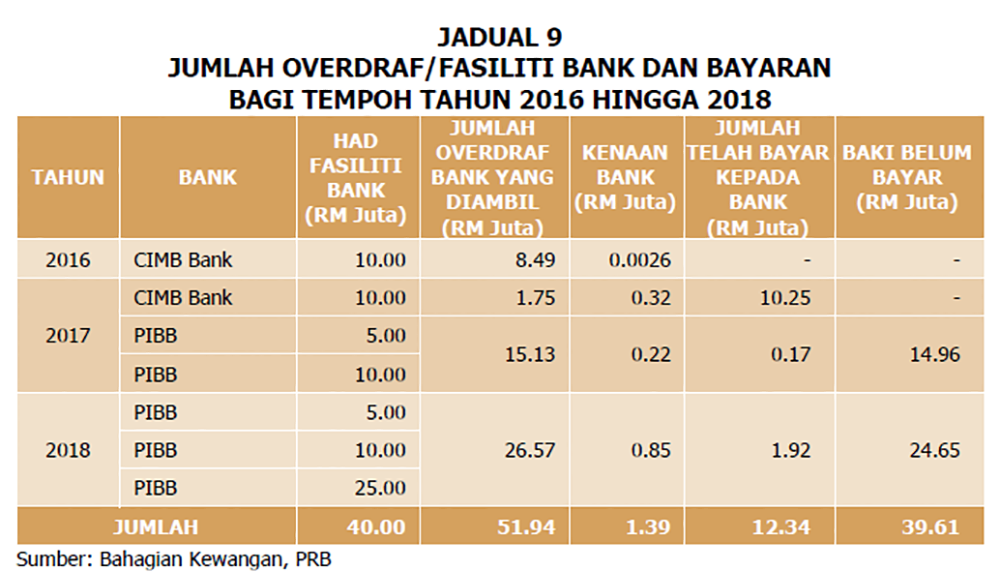

RM26.57 million of the overdrafts were made in 2018 from Public Islamic Bank Berhad (PIBB). PRB also made RM15.13 million in overdrafts from the same bank in 2017.

Overdrafts were also made with CIMB, totalling RM8.49 million in 2016 and RM1.75 million in 2017.

The total fees incurred was RM1.39 million.

In 2017, an RM10 million overdraft from PIBB was used to pay off the CIMB overdraft, which PRB terminated due to getting better rates from the former.

RM500,000 of an overdraft was also used to repay PIBB in 2018.

Meanwhile, RM20.45 million was given as an advance to subsidiary PRB Grid Technology Solutions Sdn Bhd, without any charges or fixed repayment date. This advance has not been repaid as of June 2019.

PRB also used RM6.5 million to finance personal loans applied by Risda group staff.

As of 2018, RM39.61 million of the overdrafts are yet to be repaid.

PRB, in response to the audit, defended the use of overdrafts as a temporary measure which was part of business and cash flow management strategies.

However, the National Audit Department said the use of overdrafts showed PRB's inefficiency in managing its finances.