BUDGET 2023 | Prime Minister and Finance Minister Anwar Ibrahim re-tabled Budget 2023 in the Dewan Rakyat today.

This was the first time Anwar has tabled a budget in 26 years. The theme for his budget is “Membangun Malaysia Madani” (Developing a Civil Malaysia).

Budget 2023 has to be re-tabled because it was not passed before the Dewan Rakyat was dissolved in October last year.

Thank you for following Malaysiakini’s live report.

PM wants healthy competition

6.15pm: After almost two hours, Anwar ends his speech by urging MPs to fight corruption together.

“We may have our differences, but don’t allow our differences to stop us from making meaningful change.

“If you want to compete, it should not be in a race to the bottom.

“A contest should be based on fastabiqul khairat - a race that brings good,” he says.

This marks the end of our live coverage of the Budget 2023 speech.

To learn more about Budget 2023, visit our interactive page.

Contribution for EPF accounts with less than RM10k

6.12pm: The government plans to contribute RM500 into EPF accounts with less than RM10,000. This is limited to members who are aged between 40 and 54.

Anwar says this will benefit some two million EPF members.

He says the government wants to help individuals affected by the Covid-19 pandemic rebuild their retirement funds.

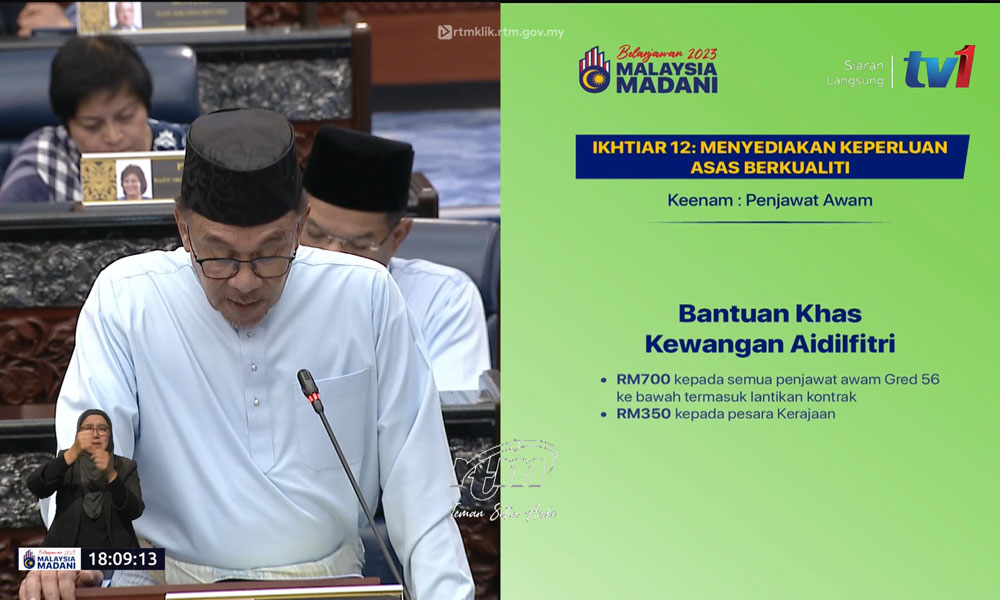

Aidilfitri cash aid for civil servants

6.10pm: Anwar announces a RM700 Aidilfitri assistance for all civil servants grade 56 and below - including contract workers.

Meanwhile, pensioners will get RM350 in special aid.

New Health Ministry recruits, health scheme

6.05pm: The government aims to take in 1,500 new medical officers, dental officers, and pharmacists on a permanent or contract basis.

A new health scheme dubbed the Madani Medical Scheme for the poor to have access to private health practitioners will be introduced.

The scheme is modelled after a similar scheme in Selangor.

From the year 2023 onwards, tax relief for medical expenditure has been increased to RM10,000, up from RM8,000 previously.

PTPTN moratorium

6.00pm: National Higher Education Fund Corporation (PTPTN) borrowers earning less than RM1,800 will be granted a six-month moratorium in payments, with applications open starting March.

Anwar says this is to allow borrowers who qualify for the moratorium some time to find better-paying jobs.

Meanwhile, the government is also giving a 20 percent discount on PTPTN repayments for three months, also starting in March.

MRT3 cost-cutting

5.55pm: Putrajaya will find ways to reduce the cost of the Mass Rapid Transit 3 project.

Anwar says the project was estimated to cost RM50 billion and his administration aims to pare it down to RM45 billion.

The savings, he says, will be redistributed to the people.

The government will also test an unlimited bus travel card for Johor Bahru, known as myBAS50.

At least RM300m for Sabah, Sarawak

5.45pm: Anwar is promising “at least” RM300 million in special payments to Sabah and Sarawak. However, there is no timeline for these payments.

Under the Federal Constitution, Putrajaya is obliged to pay Sabah and Sarawak annually, but that sum remained relatively unchanged from the 1970s until now.

The two territories were paid RM125.6 million each in 2022 and this amount will increase to RM142.6 million by 2026.

Tax cuts for M40

5.32pm: The government is proposing cutting taxes by 2 percent for the RM35,000 to RM100,000 taxable income band.

Anwar says some 2.4 million taxpayers will benefit from this policy.

He says this policy is necessary because the M40 (middle 40 percent of income earners) has been very patient in recent years while the B40 group received the most government help.

Those with a taxable income above RM100,000 will see an increase in taxes of between 0.5 percent to two percent.

“However, fewer than 150,000 taxpayers will have to deal with higher taxes,” he says.

Anwar adds that, overall, the government expects to collect RM900 million less in personal income taxes due to these changes which he says is to benefit the M40 group.

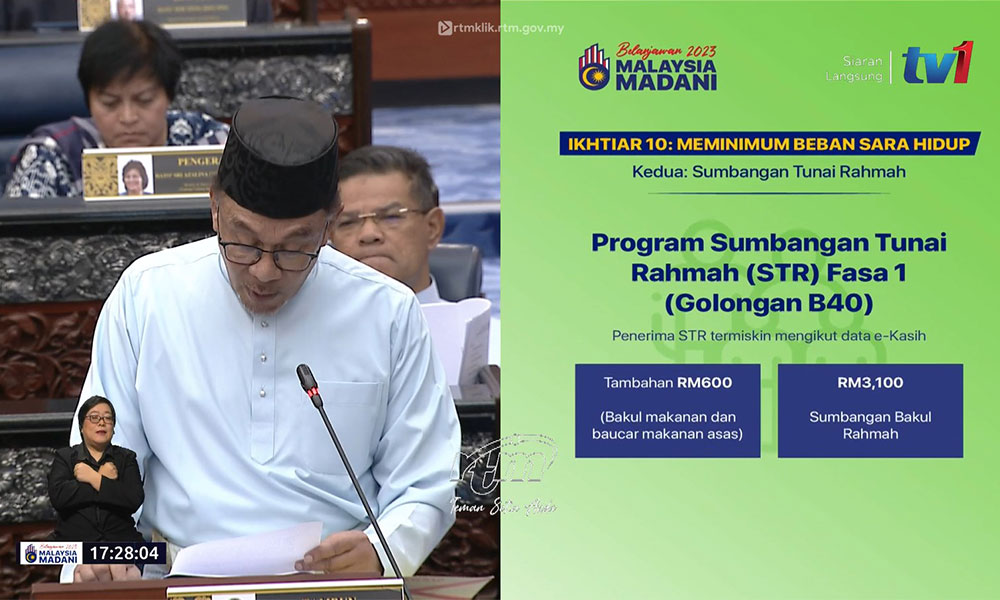

Sumbangan Tunai Rahmah cash handouts

5.30pm: The government will pay up to RM2,500 for households with a combined income of less than RM2,500. The quantum depends on the number of people in the household.

Those who are in the e-Kasih database, under the Women, Family, and Community Development Ministry, will receive another RM600 in the form of food baskets or vouchers.

Two million youths from 18 to 20 years old will be eligible for the “e-Tunai Belia Rahmah” scheme, amounting to RM200 per individual.

Hefty subsidy bill

5.25pm: The subsidy bill for 2023 is expected to reach RM64 billion - slightly lower than 2022 (RM67.4 billion) but a massive leap from 2021 (RM23 billion).

Anwar explains that subsidies are needed for price controls, financial aid, and “providing the best services for the rakyat.”

Funding for start-ups

5.20pm: Government-linked companies (GLCs) such as Khazanah Nasional Bhd and funds such as the Employees Provident Fund (EPF) will allocate RM1.5 billion to invest in local start-ups.

The government’s Malaysia Co-Investment Fund (MyCIF) will also prepare RM40 million in funding for start-ups.

Tax breaks of RM1.5 million for the cost of listing on the ACE (Access, Certainty, Efficiency) and Leap (Leading Entrepreneur Accelerator Platform) markets will be provided up to the 2025 assessment year.

Tech companies that will be listing on the Bursa Malaysia main board will also benefit from this tax break.

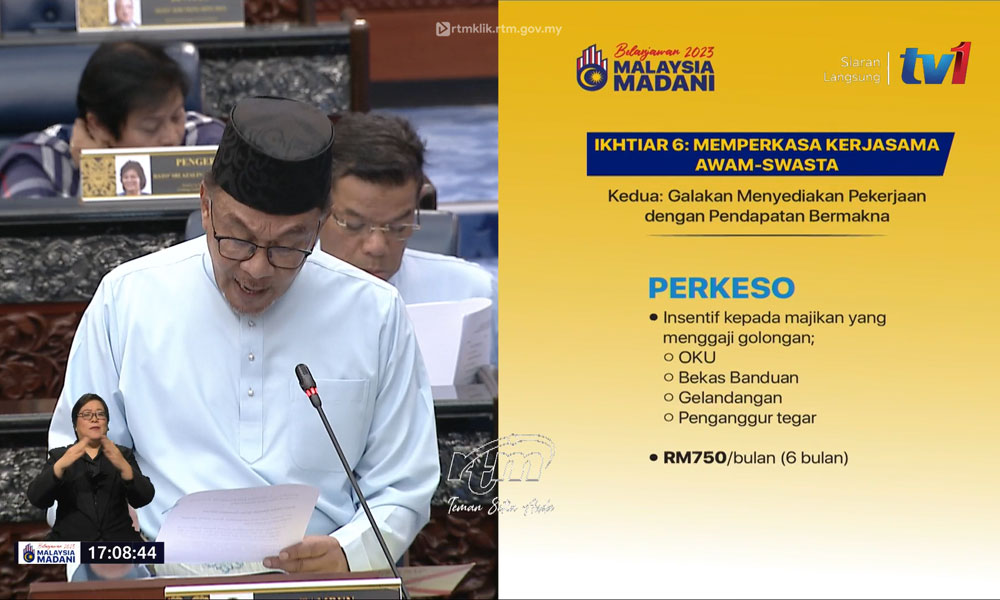

Hiring incentives

5.10pm: The Social Security Organisation (Socso) will provide employers with incentives for hiring graduates, especially Technical and Vocational Education Training (TVET) graduates.

The incentives amount to RM600 per month for three months, for up to 17,000 graduates.

Similar incentives will also be offered to employers who hire people with disabilities (PWD), former convicts, or the homeless, amounting to RM750 per month for six months.

Socso will also offer 30,000 existing gig workers a RM4,000 subsidy for training programmes.

While undergoing training, the gig workers will be able to claim RM300 a month as compensation for lost income.

Relief for bankrupt individuals

5.05pm: The government plans to expedite the process to allow qualified individuals to be released from their bankruptcy status.

This will require amendments to the Insolvency Act 1967, which Anwar says will happen soon. He expects 130,000 people to be discharged as a result of the amendments.

In the interim, he says, those who have resolved their debt in cases lower than RM50,000 will be automatically discharged from their bankrupt status on March 1.

Curbing scams

5.00pm: The government intends to beef up the National Scam Response Centre to help the public deal with banking scams.

Anwar says Bank Negara will impose a “kill switch” policy that will require banks to allow depositors to freeze their accounts or ATM cards themselves to prevent suspicious activities.

Transparency efforts

4.55pm: The Anwar administration pledges to legislate a Government Procurement Act as soon as possible to improve transparency.

The prime minister also pledges to improve the Whistleblower Protection Act 2010 to better protect those who want to report corruption.

Wakaf assets to be developed

4.50pm: Only 12 percent of wakaf land has been developed, Anwar says. The government will increase efforts to unlock the value of wakaf assets.

Wakaf is the donation of money or property as a charity for religious causes.

Anwar reveals the government has secured the commitment of the private sector based on assets worth RM1 billion.

These assets will be optimised to benefit those in the lower income bracket as well as other needy groups, he adds.

Incentives for E&E, aerospace

4.40pm: The government plans to attract the electrical and electronics as well as aerospace industries, which were affected by the pandemic, back to Malaysia.

To achieve this, the government plans to provide tax incentives to companies that relocate to Malaysia and a tax rate of 15 percent for the C-suite until 2024.

Existing tax incentives will be extended until Dec 31, 2025 to expand the existing capacities of those industries and attract more investments from abroad.

Fresh tender for flood projects

4.35pm: Six planned flood mitigation projects awarded by the previous administration will be open for a fresh tender, no later than June.

This includes projects in Johor, Selangor, and Kelantan.

Anwar says this exercise is expected to save the government RM2 billion, compared to the RM15 billion estimated by the previous administration.

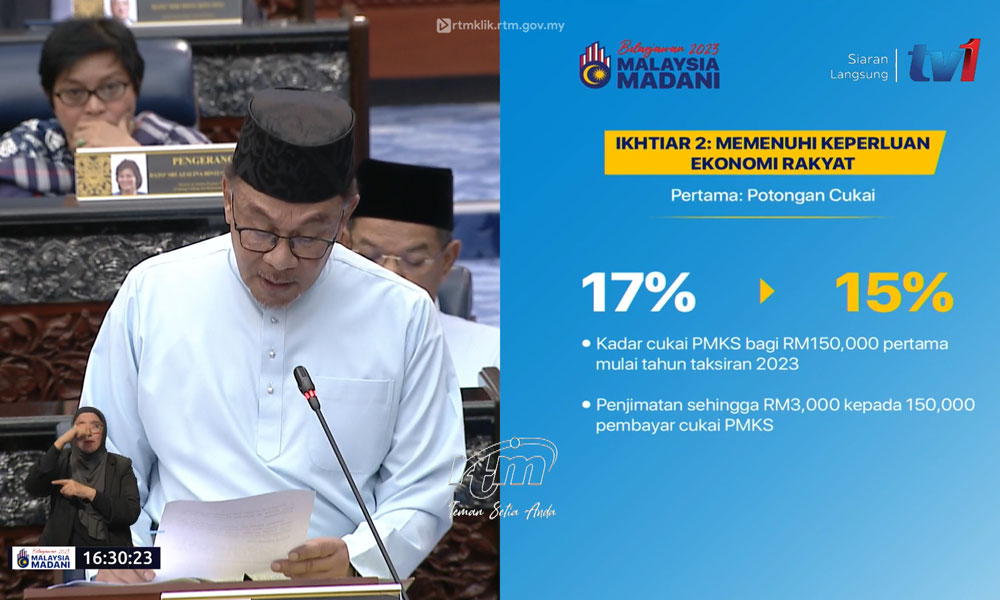

Taxes for small businesses reduced

4.30pm: Taxes on the first RM150,000 in revenue of micro, small, and medium enterprises will be reduced to 15 percent, down from 17 percent.

This will save those businesses up to RM3,000 in taxes.

The government will also allocate RM50 million to build new stalls or kiosks for small traders throughout the country.

The government plans to subsidise the cost of vehicle licence tests for the following licences: B2 motorcycle, taxi, bus, and e-hailing.

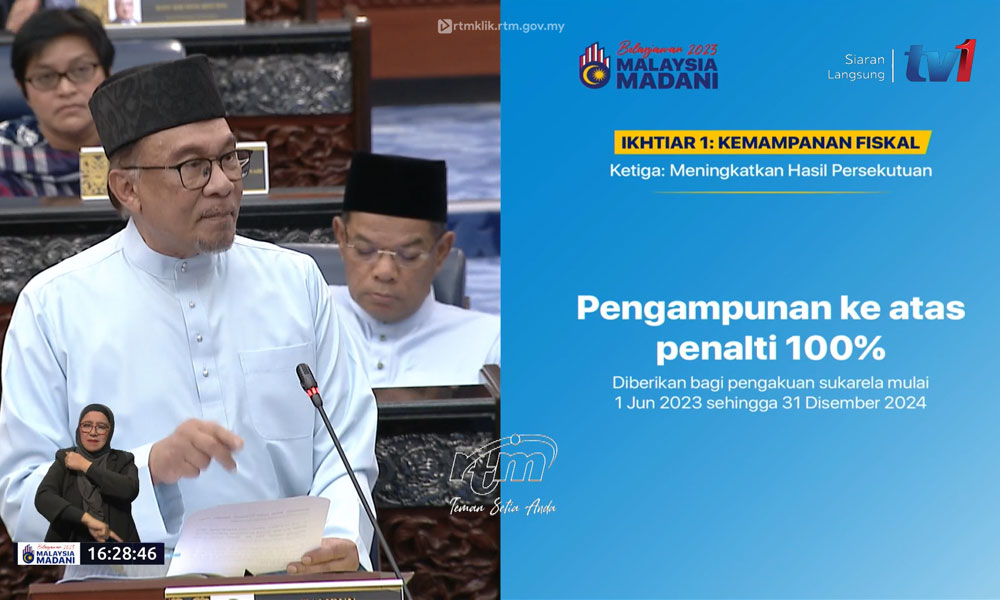

New taxes on luxury goods, capital gains, tobacco

4.25pm: The government intends to introduce new taxes.

This includes a luxury tax, capital gains tax, as well as taxes on tobacco and vape products.

The government will also re-introduce a scheme to waive the penalties for self-declaration of unpaid taxes.

Commitment to reduce govt debt

4.20pm: Anwar says his administration is committed to reducing government debt to 3.2 percent of GDP by 2025.

He says debt stood at 5.6 percent and 5 percent of GDP in 2021 and 2022 respectively.

Future loan-taking by the government, he adds, will only be focussed on cheap loans and expenditure that brings returns to the country.

Bleak outlook

4.15pm: Anwar paints a bleak outlook for 2023, noting that global economic growth is expected to slow to 2.3 percent.

As for Malaysia, he says the country grew by 8.7 percent in 2022 due to a low base in 2021.

However, he notes that quarter-on-quarter growth has been reducing from 3.8 percent to 3.5, 1.9, and -2.9 over the course of 2022.

Nevertheless, the government projects the Malaysian economy to grow by 4.5 percent in 2023.

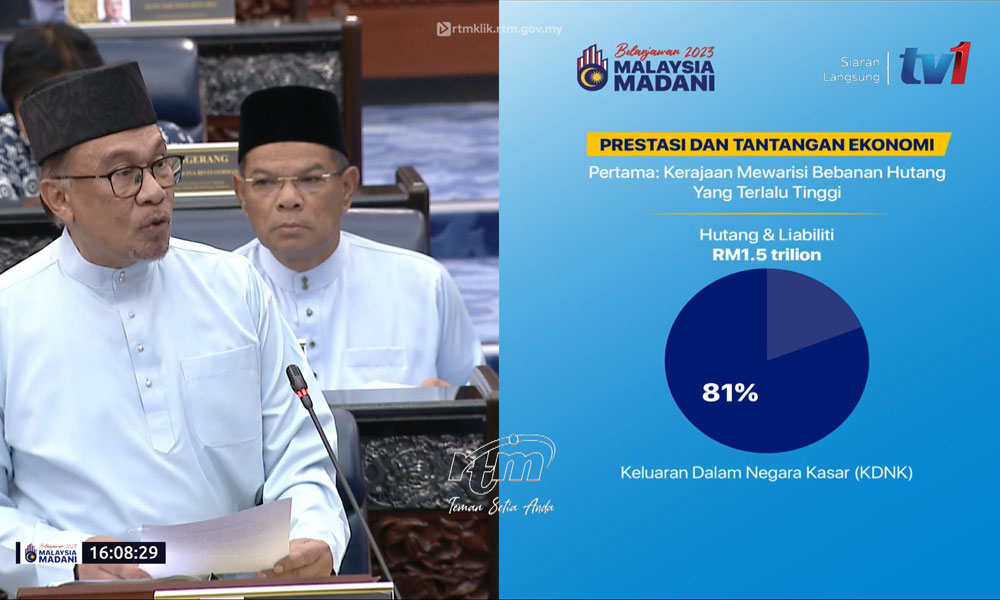

Debts and liabilities hit 81pct of GDP

4.10pm: The finance minister reveals that Malaysia’s debts and liabilities stood at RM1.5 trillion - around 81 percent of gross domestic product (GDP).

Around RM46 billion was used to pay debts alone. This amounts to 16 percent of government revenue - above the 15 percent limit.

“That is just to serve interest payments, not the principal,” Anwar says.

Higher revenue than expected

4.01pm: At RM291.5 billion, revenue for 2022 was higher than what was collected in 2021.

Unlike the past two years, the government will no longer be allocating any funds for Covid-19 response which took up 5.3 percent of Budget 2021 and 6.9 percent of Budget 2022.

Biggest budget ever

4.00pm: Budget 2023 is up 16.3 percent from the previous year and is the largest budget on record - even bigger than the one tabled by Anwar’s predecessor Tengku Zafrul Abdul Aziz in October last year.

Total budget for 2023: RM386.10 billion

(↑ 16.3 percent, 2022: RM332.1 billion)

Operational expenditure: RM289.1 billion

(↑ 23.8 percent, 2022: RM233.5 billion)

Development expenditure: RM97 billion

(↑ 29.3 percent, 2022: RM75.6 billion)

Revenue for 2022: RM291.5 billion

(↑ 24.6 percent, 2021: RM234 billion)

Projected deficit for 2023:

5 percent (2022: 6 percent [estimate])