Mr Lee, 63, from Kuala Lumpur, had spent more than three decades managing shop licences and was finally preparing for retirement. He believed a few smart investments could grow his savings and secure his family’s future.

Instead, he was drawn into fraudulent schemes. What he hoped would fund his retirement has left him in debt - caught in a nightmare he never imagined.

This is his story as told to Malaysiakini.

In March 2025, I came across a post on Facebook offering “free 99 Speedmart shares”. The first time I saw it, I ignored it. The second time, I clicked.

That click took me to WhatsApp, where a woman named “Joanne” contacted me. Essentially, the post offering free shares had nothing to do with 99 Speedmart shares. It was simply a gimmick to get unsuspecting people to click on the link.

Lured by huge profits

Joanne added me to a chat group filled with dozens of people who looked like a marketing team. They convinced me to download an app called XGI Horizon from Google Play Store. I was told that upon registration for an account, I would receive a RM400 bonus to start investing.

At first, the app showed huge profits and looked promising. A RM1,000 deposit would yield several thousand ringgit. The first time around, I deposited RM5,000. On the same day, I saw a return of RM6,000 in my bank account. In a short time, I made a profit of RM30,000, which I managed to withdraw.

After that, I was introduced to another investment programme, also under XGI Horizon, which I was informed was a Hong Kong-registered asset management firm.

Excited over the prospects of huge returns, I encouraged my brother to join the scheme as well. Before long, we had RM200,000 sitting in my account on the platform.

The IPO trap

I joined a scheme where, for every deposit of RM10,000, one would get RM100,000. So if you have only RM3,000 in your account, you’d need to top up another RM7,000 for the sum to reach RM10,000 to turn a RM100,000 profit. Bit by bit, I sank deeper. At this juncture, I was depositing money every few days.

Joanne kept introducing new schemes, like an IPO for a Chinese firm called “Keong Tat”. This one required an investment of RM100,000. My brother dug into his funds, and I withdrew money from the bank to make up for the balance.

And then I stumbled upon another Chinese IPO, this one was called “Chun Fong”. When I had accumulated RM500,000 in the account on the platform, I decided to withdraw half of the sum. But I was told I couldn’t do that because Chun Fong was a “RM700,000 scheme”.

Joanne said I had to top up another RM200,000 before I could withdraw my money. She also threatened that if I didn’t deposit the balance, my family members would lose their access to online services (although she didn’t have their personal information), and I could face trouble with the authorities.

I approached a friend to borrow the RM200,000. After listening to my story, he said it all sounded very much like a scam. He urged me to leave the schemes immediately. It never occurred to me that I’d been scammed.

Joanne blocked my access to my Chun Fong IPO account after I failed to deposit the balance of RM200,000. This effectively prevented me from retrieving my money.

Not giving up, Joanne claimed she had borrowed RM60,000 on my behalf, and if I could deposit RM100,000, I’d be able to take home RM1 million. Tired of her manipulations, I lost hope of getting back my money. I thought everything was over, and I’d lost all my funds.

I encountered even more schemes after that, unrelated to XGI. Another app, MYTGI, claimed that I could grow RM100,000 into RM400,000 in 40 days. My brother naively suggested that we participate in it so we could raise the money needed to retrieve the funds we’d poured into the XGI Horizon investment. I didn’t sign up for it.

The fake lawyer

That was when I saw advertisements for a lawyer on Facebook. They looked convincing, and because he was based in Malaysia and presented himself as a “big lawyer” from a prominent law firm in Kuala Lumpur, I thought I could trust him.

He called himself “Dennis Koh”. He promised to help me recover my money and said we would meet at his office once the funds came through. That never happened. The law firm is a reputable and legitimate one, but Dennis Koh didn’t work there. I found out belatedly that he was a fake.

Dennis connected me to “David”, who said he was from an anti-corruption group and knew about my situation, that I had been swindled out of more than RM200,000, and he could help me. But according to him, the only way was through a casino.

Communicating over Telegram, I told him I didn’t gamble. He said, “No problem. I’ll give you US$100. Go in, and I’ll be online at 2.45pm. You only have 15 minutes.”

He explained that in that short window, the odds would change - from 1.9 times to 2.1 times; and that I could only play three rounds - one big, one small - each time.

It was a Hong Kong-based casino platform, and gambling took place through an app. At first, he gave me US$100. I didn’t win anything. He said if I could “catch up”, he would add more money.

I decided to invest my own money. I had about US$10,000 in the account and, seeing that the sum seemed to be growing, I felt confident. Then, by accident, I clicked on the wrong button. I saw my US$300 bet yield US$20,000.

I thought I had really made US$20,000, but then David said the app had a “problem”. He told me to wait a week while he “fixed it”. He also warned that time was running out because they “couldn’t keep hacking into other people’s accounts”, and I was an accomplice in hacking the casino.

About five days later, David messaged me again. He said the only way now was to “fix the hole” (plug the funds gap) with money. It would cost US$7,000. I paid. Then he claimed there was a “big hole” and a “small hole.” For the small hole, I needed another US$7,000. I paid again.

I started gambling again, and after that, about RM110,000 appeared in the account. I tried withdrawing US$100, then US$500, and it worked. That gave me confidence. At one point, I had altogether about US$400,000 in the casino account. But when I tried to take it out, I couldn’t.

David told me the casino had discovered that my account had “hacked” theirs. The only way, he said, was to pay a fine. After that, I could get my money back. He also insisted I pay a US$7,000 “tax” because, as he put it, “Casinos in Hong Kong must pay tax.” So I paid.

Then he said I had to become a member of the casino platform to withdraw more than US$100,000. I agreed, but before my membership could be activated, I accidentally hit a button too quickly. That led to another fine.

Endless payments, no way out

By then, I started feeling very uneasy. Why did I keep having to pay more taxes and fines? His explanations in those last conversations made me suspicious. Still, the message was clear: I couldn’t get my money back unless I kept paying.

I called Dennis, the so-called lawyer, and he told me, “If you do this, you can get your money back.” What he said was exactly the same as what the XGI Horizon people had told me.

I asked Dennis why his explanation matched word for word what XGI had said. He didn’t answer me. By now, what he told me on the phone wasn’t always the same as what he previously said in our WhatsApp conversations.

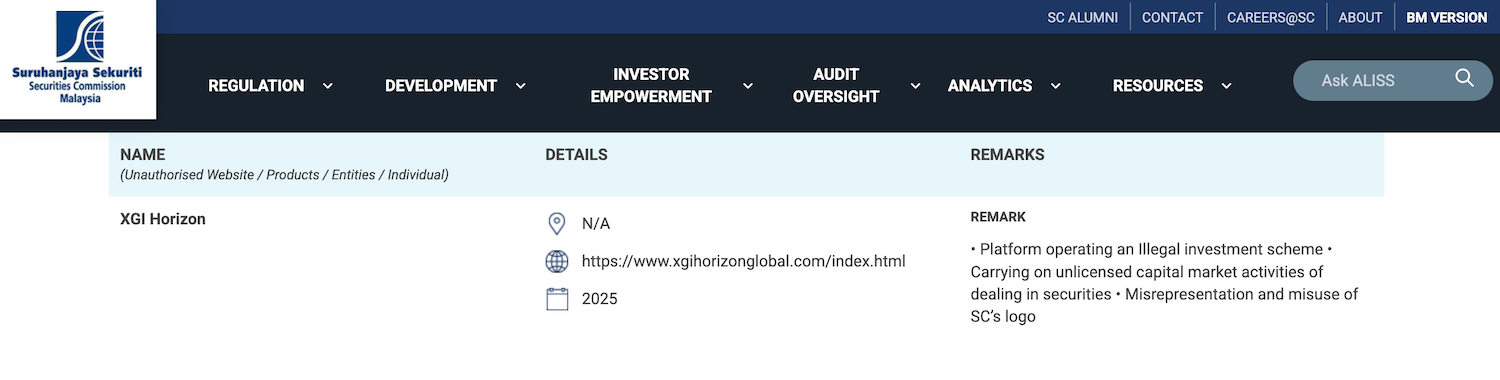

The few people who knew what was going on urged me to check on the Companies Commission of Malaysia (SSM) website to see if XGI Horizon Limited was registered as an investment company in Malaysia. The search turned up nothing, but an investment platform called XGI Horizon was on the Securities Commission Malaysia’s investor alert list, flagged for illegal activities.

Although I knew for sure by then that I’d been scammed, I was reluctant to leave because I had already poured so much money into the schemes. I still harboured hopes of recovering the funds. I kept thinking, “Maybe if I invested a little more, I could get my money back.”

In total, I managed to withdraw only small amounts - about RM30,000 from the first scheme I invested in and US$600 from the online casino site. At one point, the scammers even demanded a 20 percent “commission” before releasing any funds. Of course, nothing came back.

Too late

Around the same time, I found a Facebook post bearing the Global Anti-Scam Organisation (GASO) logo. That’s how I got in touch with Alicia from the group. GASO is a non-profit organisation registered in the United States that provides support to scam victims.

Alicia told me plainly: “It’s impossible, there’s no way for you to recover your money.”

Her honesty helped me see through yet another layer of deception - fake groups posing as “anti-fraud” or “anti-corruption” organisations, promising to retrieve victims’ money. They are recovery scammers.

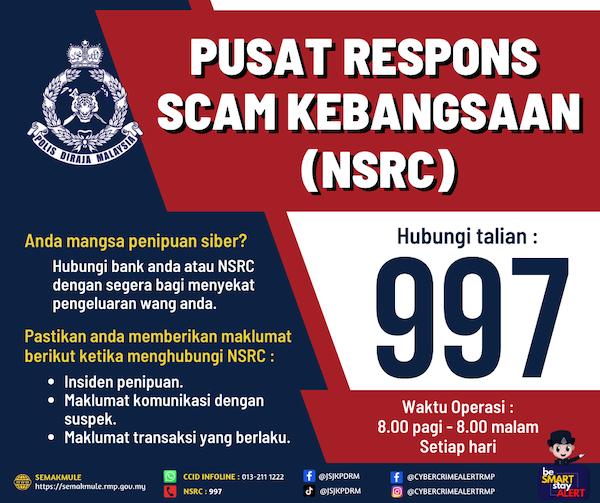

In May, two months since the nightmare began, I finally lodged a police report. Between March 12 and April 18, I had made 18 bank transactions to five different company bank accounts. At the police station, I saw other victims - one couple had lost more than RM500,000.

Later, I read that hundreds of Malaysians had fallen for the same XGI scam with losses running into the millions. I lost over RM300,000.

My brother, whom I regrettably introduced to the scams, lost around RM150,000. Sadly, he is in denial and refuses to believe that it was all fraudulent and that we both had been duped.

Today, I no longer trust anything I see online, especially when it involves money. Seriously, there’s no such thing as a free lunch. If I had acted earlier, perhaps I could have avoided some losses. But it’s too late for me. The only thing I can do is tell my story so others won’t fall into the same trap.

I am 63 years old, preparing for retirement. I hoped to provide for my family, especially my three grandchildren. I only wanted to have enough funds to buy two houses for them, to secure their future. Instead, I lost my savings and even borrowed money for the fake investments. I now struggle to repay the debt.

It isn’t easy for me to tell this story. I’m a private person. But I hope that by speaking out, others will think twice before trusting offers online that sound too good to be true. Beware if you encounter investment deals promising high returns in a ridiculously short time.

*Editor’s note: Scam survivor's name has been changed to respect his privacy and to avoid prevailing stigma against him.

If you suspect that you may have been scammed, contact the National Scam Response Centre’s hotline at 997 for help.

If you’re feeling distressed, depressed or suicidal, reach out to a health professional or call the Befrienders’ emotional support hotline at 03-7627 2929.

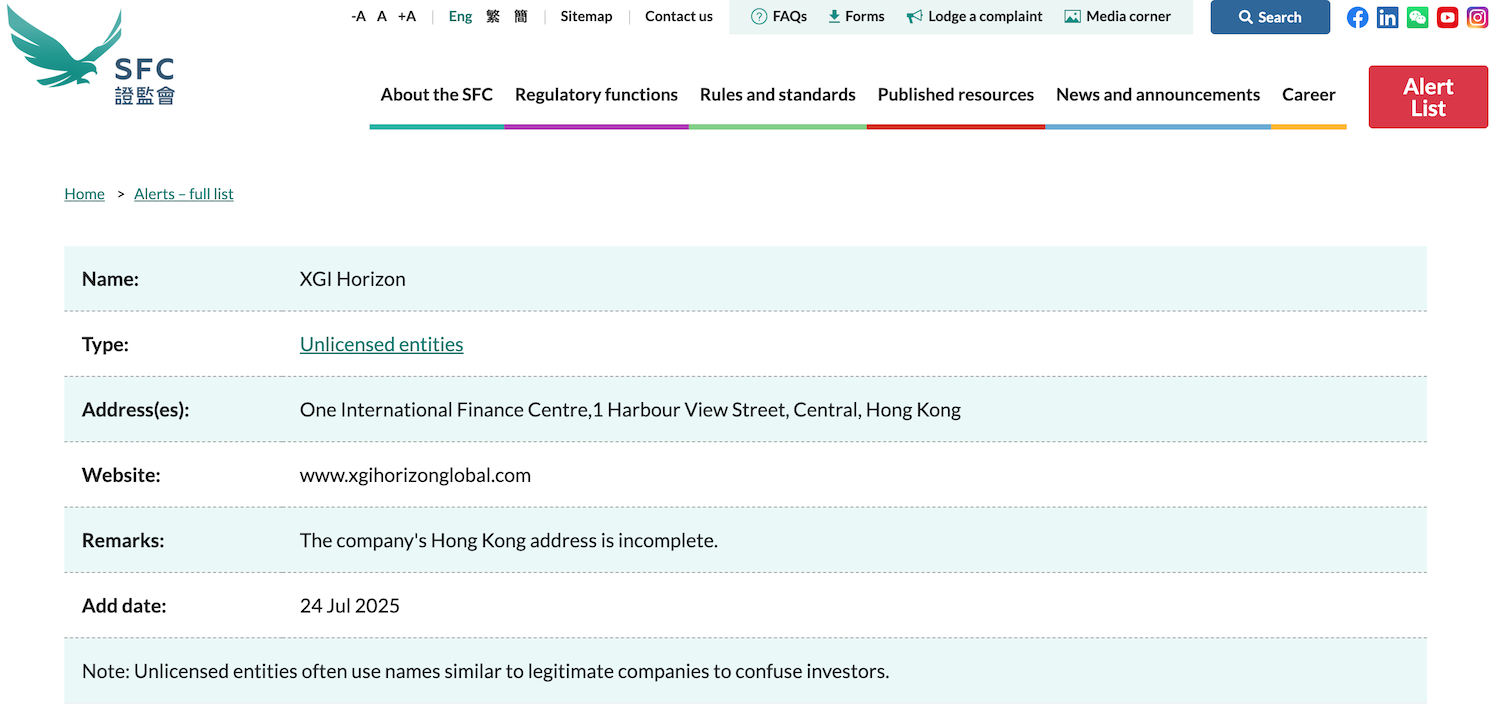

XGI Horizon Limited appears in the Hong Kong Companies Registry. Its corporate website, which is no longer accessible, states that it is an “Asia-based asset manager with offices in Hong Kong”.

Hong Kong’s Securities and Futures Commission, in its July 24, 2025, alert list, flagged XGI Horizon as an “unlicensed entity”, meaning it is not authorised to conduct regulated financial activities in Hong Kong.

Malaysiakini’s checks found that while XGI Horizon Limited is not a business registered under SSM, three other Malaysia-registered companies with similar names were found in the CTOS Malaysia database:

XGI Horizon Empire, incorporated on Dec 31, 2024, listed its business activity as “wholesale of construction hardware”.

XGI Horizon Construction Sdn Bhd, incorporated on Feb 19, 2025, listed its business activity as “wholesale of a variety of goods without any particular specialisation NEC”.

XGI Partners Group Sdn Bhd, incorporated on Feb 28, 2025, listed its business scope as “wholesale of a variety of goods without any particular specialisation NEC” and “information communication technology (ICT) system security”.

Further checks revealed that these companies’ bank accounts have been used to receive funds from unsuspecting investors of the fraudulent schemes.

Resources

Before investing, check the scheme's legitimacy:

- Securities Commission registry of authorised digital asset exchange companies

- Bank Negara's list of unauthorised investment companies and websites (This list shows entities which are not authorised and is not exhaustive.)

- Bank Negara’s list of authorised trading platforms

- Bank Negara’s list of authorised financial sector participants

You can also check the website address:

- Tool to see when the website was created (Scam-related websites are often, but not always, newly created.)

Before you make any bank transfers:

- Check the recipient bank account number on the police’s Semak Mule website

- If the account holder is a company, search for the business’s information in the SSM database. Companies linked to scam accounts are often, but not always, newly created.

This S.A.F.E. Internet Series is in collaboration with CelcomDigi.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.