Artificial intelligence is usually talked about as a force reshaping business, industry, and even the arts. But at the World Social Security Forum (WSSF) 2025 in Kuala Lumpur, the focus turned to something far more down-to-earth: how AI is already being used to help people access social protection when they need it most.

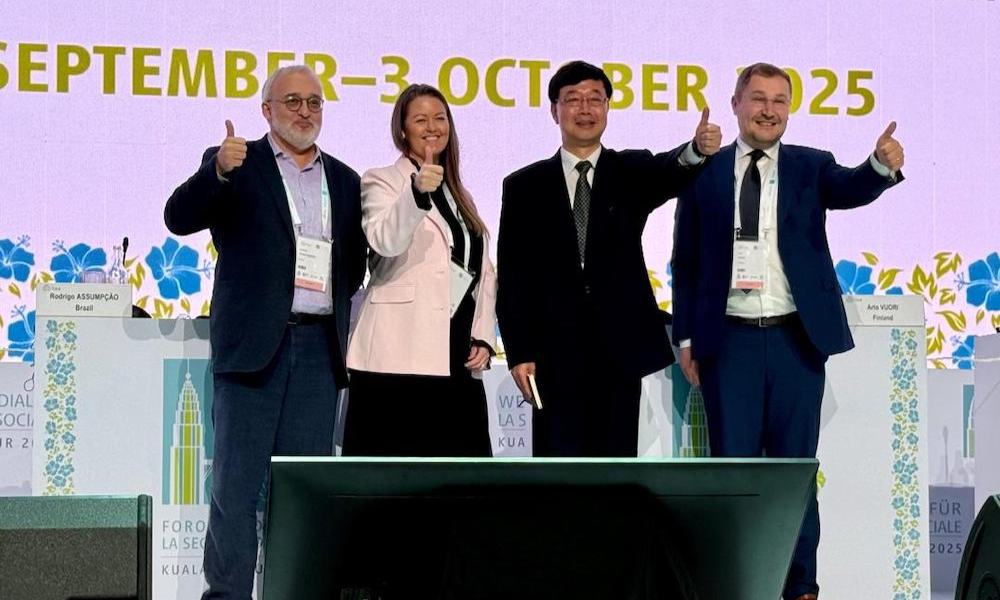

In an interactive session on “Artificial Intelligence in Social Security Organisations”, Rodrigo Assumpção, President of Dataprev, Brazil’s Social Security Information and Technology Enterprise, led a conversation with three leaders from across the globe: Tenille Collins, Chief Data Officer at Services Australia; Yanli Zhai, Director-General of Social Insurance Administration at China’s Ministry of Human Resources and Social Security; and Arto Vuori, Director of Information Services at Finland’s Social Insurance Institution, Kela.

Each came from a different starting point, but together they painted a picture of AI not as a distant future, but as a tool that, if handled carefully, can make social security fairer, faster, and more accessible.

Reaching the hard-to-reach

One of the clearest benefits of AI has been its ability to bring services closer to those who might otherwise be left behind.

In China, social security agencies have introduced intelligent kiosks in the remote mountain villages of Guangdong Province so residents can apply for benefits without travelling long distances. Pensioners now use facial recognition instead of in-person checks to prove their eligibility.

For Zhai (above, left), success means making the technology almost invisible. “If people can feel that there’s artificial intelligence, then it proves a failure for us,” he said. The point, he argued, is not to dazzle people with innovation but to smooth the process so services simply work.

Looking ahead, Zhai was strikingly optimistic: “In my vision, within the next five years, the number of staff in my organisation will be doubled. I mean, half of them will be robot assistants.” For him, the future lies in carbon- and silicon-based staff working side by side.

Finland has applied AI in a different way, using analytics to move from a benefit-by-benefit approach to one based on life situations. Most people - around 80 percent - have stable needs and can be served through straightforward, automated systems. But a small group with complex or prolonged problems consumes more than half of Kela’s service resources.

AI helps identify these individuals and free up caseworkers to spend more time with them. As Vuori (above, right) put it: “The analytics is an enabler of service development and delivery.”

Speed in moments of crisis

For Australia, the real test has come in times of disaster. Over the past five years, the country has been battered by fires, floods, and other crises. To get money quickly to people in distress, Services Australia turned to automation.

“Millions of claims have been processed, with money reaching customers’ accounts within two hours,” said Collins. The scale is huge: more than a billion dollars in emergency payments disbursed in five years.

But speed has not come at the expense of care. AI is also used to detect risks that might otherwise be missed, such as signs of self-harm or family violence, ensuring those cases are escalated to human officers. “Always human in the loop,” Collins stressed. “That interaction is critical.”

Guardrails of trust

If there was one message that cut across all three countries, it was this: AI is only as good as the foundations beneath it. That means reliable data, clear rules and public trust.

Collins compared it to building a house: “Sensible people don’t build houses on shaky foundations. You need to consider your data, your data quality, how you’re managing data across your organisation. And you need the right skills, the right tradespeople, so your house can withstand the generations.”

In Finland, that foundation also includes openness. Kela has appointed an AI governance lead, created a public register of AI projects, and actively shares its data insights online to show how models are being used. “We want to win the support of Finnish citizens,” Vuori emphasised. “That legitimacy comes from showing our work.”

China, meanwhile, is writing new regulations to govern the partnership between “carbon-based and silicon-based staff.” While robotic process automation has already boosted efficiency by fivefold, Zhai cautioned that AI should be seen as a facilitator, not a replacement. “AI can speed up the process, but it does not change the nature of social security management,” he added.

Different systems, shared challenges

Beneath the surface, every country faces difficult trade-offs. Australia insists that all citizen data remain onshore, forcing vendors to build local servers. Finland, while adopting more cloud services, sets strict rules on where its data can be processed. These requirements slow down implementation but are seen as essential for maintaining public trust.

For countries with fewer resources, Collins offered practical advice: start small. “Don’t get distracted by all the shiny balls. Pick one or two things, deliver them well, and build from there.”

Putting people at the centre

Despite their different paths, the panellists agreed on one essential point: AI should never overshadow the human purpose of social protection. It should extend services to underserved communities, deliver help quickly when lives are turned upside down, and support staff in handling the most complex cases.

Moderator Assumpção added another note of caution: citizens themselves are now starting to use AI tools to deal with government agencies. “That brings a new mix into the game,” he said. “We are using AI to control AI. But who watches the watchman? Who is going to control all this structure?”

He concluded with a reminder to the room: “AI has become too important to be left only to IT people. Leaders of social security must engage. We don’t need to understand the intricacies of the algorithms, but we must understand the impact.”

Whether AI in social security proves to be a revolution on the scale of personal computers or as transformative as electricity remains to be seen. What matters now is that institutions use it wisely - keeping equity, trust and people at the heart of every decision.

This Social Security series is in collaboration with PERKESO.