When GST was implemented on April 1, 2015, Malaysians from all sectors were angered by and doubtful about the tax system. Despite the repeated reassurance by members from Barisan Nasional that GST will benefit Malaysians, many just do not feel it.

Over the course of 2.5 years since GST was implemented, consumers are paying higher prices for most goods. Moreover, many small businesses experienced higher business costs which partially contributed to the rise in prices of goods, and lost customers as a result of lowered consumption in the market. Some businesses were even forced to close down.

Let’s not forget that when GST was introduced, Malaysia was facing other economic challenges such as the weakened ringgit, the oil and gas crisis, a loss in market confidence due to financial scandals, slower market activity which led to retrenchments and job cuts, as well as persistently increasing cost of living in contrast to stagnant wages.

However, nothing was felt by the BN government. The prime minister even took pride in the introduction of GST and made the infamous remark that “GST saved the Malaysian economy” which sparked anger amongst most Malaysians.

Recently, the show continues by having ministers attempting to soothe the people by saying that the Malaysian economy is doing just fine because we have good GDP growth. These are attempts to justify the implementation of GST which was actually a trick to overcome the economic troubles created by BN.

One of the most heated arguments when Pakatan Harapan proposed the abolishment of GST (in reality, zero-rating GST) was that a loss of RM42 billion revenue to the government will potentially paralyse the Malaysian economy and burn a hole in the government’s pocket.

So, is eliminating GST a myth?

In the alternative budget of Harapan, which was launched at the Parliament today, Harapan presented detailed explanations as to how it can afford to eliminate GST when the pact comes to power.

In 2017, GST collection is expected to be at RM42 billion. If we look at the pre-GST time when the Sales and Services Tax (SST) was used, the collection was around RM16 billion a year.

That is an additional RM26 billion taken away from people and hence, reduces the spending power of citizens. This explains the lower consumption rate and slower market activity, on top of the other economic problems we face.

The collection of GST was not a matter of “taking money from left pocket to right pocket”. Theoretically, neglecting administration costs and other transfer costs, if the money collected was fully spent by the government in the market, aggregate demand, consumption activity, or even spending power of the people should stay the same or even improved if the allocation of resources was properly managed and administrated.

However, this has not happened in Malaysia.

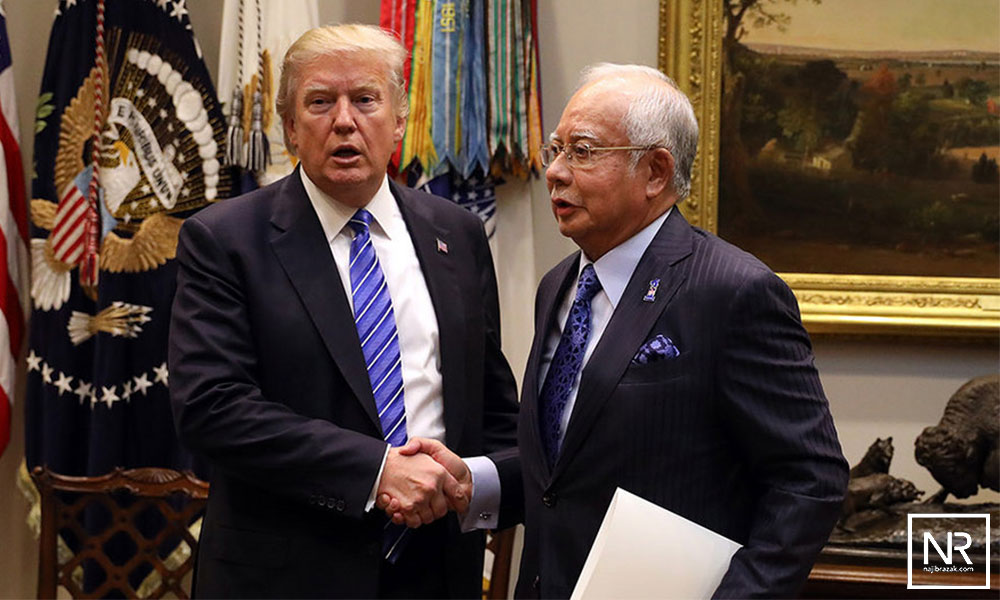

The allocation of resources has remained questionable to most Malaysians. For instance, we witnessed cuts in allocations to the healthcare and education sectors during the previous budget, yet a generous RM59 billion (USD14 billion) is on its way to strengthen the US economy.

This contradicts the “GST saved the Malaysian economy” remark as RM59 billion is equivalent to 18-months of GST collection from 1 April 2015 to 31 October 2016 - our saviour is abandoning us to save the US!

The alternative budget of Harapan has shown us how the act of eliminating GST itself will induce revenue to the government due to expected increases in consumption and business activities. The equation is straightforward - higher consumer spending power, higher consumption rate, higher profits by businesses, higher taxes and duties revenue to the government.

An immediate reversal of the dampened market activity is much needed at this moment as this will not only benefit the businesses but also the people because it means more jobs, better salaries and stronger purchasing power.

During “Himpunan Sayangi Malaysia, Hapuskan Kleptokrasi”, Harapan has pledged itself to tackle wastage and corruption problems in Malaysia. Amongst the steps proposed are strengthening the power of MACC and reinstating its independence, practising open tenders and eliminating direct negotiation for government projects, and recovering money and assets misappropriated in financial scandals.

This signifies a new hope for Malaysia because there have been enough resources disappearing from our economy as a result of wastage and corruption. When these can be reduced, prevented and eventually eliminated, no taxpayers’ money will go into the wrong hands and more money actually reaches the people for its intended use.

The spending pattern by the government has always been questionable. For example, there is an enormous amount of resources currently being held by the Prime Minister's Department (PMD). In Budget 2017, 6 percent of the whole budgeted expenditure was allocated to the PMD, which amounted to around RM16 billion.

Many of the items listed in the breakdown of PMD expenditure such as “facilitation funds” and “special funds” received no further explanation on its nature as well. In the alternative budget, Harapan is confident that at least half of the allocation to the PMD can be saved and put to better use.

With better governance and integrity in the management of resources, we do not need GST to “save the Malaysian economy”. Harapan can do it and Harapan will do it.

KERK CHEE YEE is political secretary to DAP Parliamentary Leader Lim Kit Siang.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.