MP SPEAKS | MCA president Wee Ka Siong has continued venting his political frustrations at me, particularly singling out DAP, and indirectly against Prime Minister Anwar Ibrahim and the coalition government.

His latest tirade on the depreciation of the ringgit against the US dollar is directed at Deputy Finance Minister Lim Hui Ying and I.

This does not make sense when it is Anwar who is in charge of the Finance Ministry. Why hold me responsible when I currently do not hold any government position?

So, can Wee tell us when Lim Hui Ying or I have claimed credit for the Finance Ministry’s decisions under the government when the law provides the minister with the sole statutory authority to decide on policy?

Clearly Wee is using me as the “bridge” to hit out at Anwar for not explaining the sudden fall in the ringgit’s value by criticising my call for Bank Negara to explain.

I asked Bank Negara to explain to the public that the latest drop in the value of the ringgit vis-à-vis the dollar is not due to issues or problems related to the Malaysian economy but the rising tensions in the Middle East, especially the growing prospect of a regional war between Iran and Israel.

I am bemused that Wee can question DAP’s logic behind holding Bank Negara responsible for explaining the depreciation of the ringgit. After so many years in government, including being a minister under BN, Perikatan Nasional, Umno and PAS, Wee still does not realise that currency and foreign exchange markets lie within the exclusive purview of the independent Bank Negara.

Wee can be forgiven for his ignorance since he has never had the opportunity to assume the post of finance minister. But such a shocking display of lack of simple basic knowledge obviously disqualifies him from the post.

When DAP was the opposition and Wee was a minister under the PN/PAS government, DAP placed the onus on the ruling government to be responsible for a depreciating ringgit. The ringgit at the time depreciated even though there was no war in the Middle East.

Triggered by Middle East tensions

In the absence of war, the higher interest rate differential of 2.25 percent to 2.5 percent in the US compared to Malaysia, and the poor performance of the Malaysian economy would be key factors in undermining the ringgit’s value.

As the manager and custodian of the nation’s economy, the PN government had a public duty to explain the nexus between the poor performance of the economy and the declining value of the ringgit.

The current situation of the declining value of the ringgit is triggered by escalating Middle East tensions brought about by Israel’s attack on the Iran consulate in Syria and the murder of an Iranian general.

This is evident because the ringgit hovered in the range of RM4.70 to RM4.74 to the dollar in the 16 days before April 1. On April 1, when Israel attacked, the ringgit was at RM4.72 to the dollar. Since then, in the 16 days after April 1, the ringgit has depreciated rapidly to nearly RM4.80.

Should a war break out between the countries, the value of the local note will decline even further. So far, the ringgit’s weakness is only limited to the US dollar. It is holding up well or even strengthening slightly against regional currencies, as well as the sterling, euro, South Korean won, and Taiwan dollar.

This proves that the weakening ringgit against the dollar is due to geopolitical tensions in the Middle East and not the worsening performance of the Malaysian economy.

If Wee disagrees with my reasoning, he should state his opinion of the real cause of the decline. There is no need for him to attack or sabotage his own government, of which MCA is a member.

As a reputable financial institution, Bank Negara can put forward a more persuasive defence of our ringgit that can allay the concerns and fears of both the rakyat and investors. Why then is Wee against my suggestion of Bank Negara making the explanation?

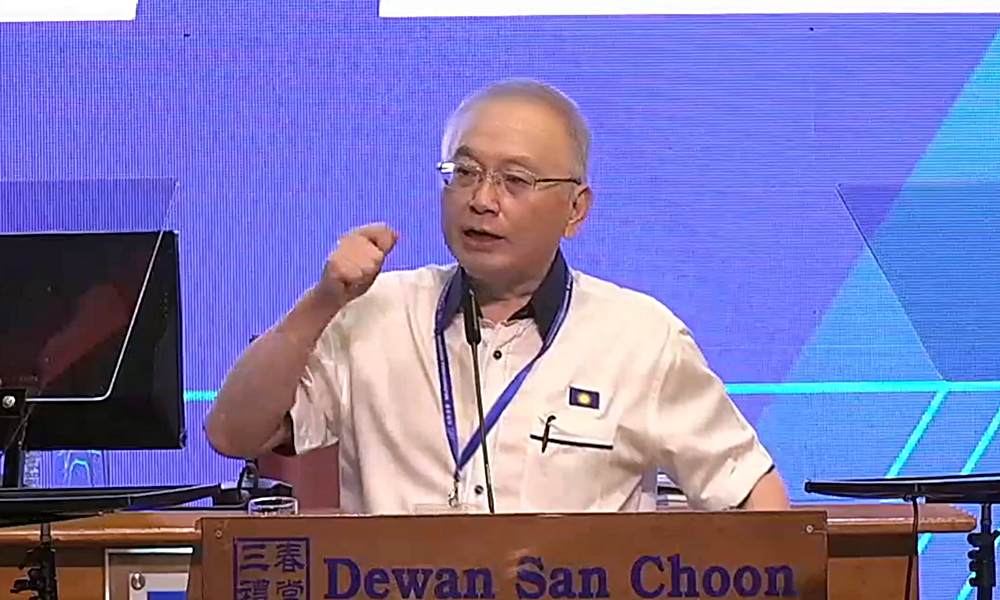

LIM GUAN ENG is Bagan MP.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.