FOCUS As the war between taxi and ride-sharing applications rages, the debate has largely revolved around how and why services such as Uber and GrabCar are well-received, compared with that from the standard taxis.

Malaysiakini has looked at this extensively in its previous three series on the Taxi-Uber war but in this fourth and final part, we look at how the legal grey area is putting Uber drivers and those they come in contact with at risk.

As regulators figure out how to deal with a novel concept, Malaysiakini has put a question, which many countries are grappling with, to Malaysia's automobile insurers: "Does private car insurance cover Uber drivers in an accident?"

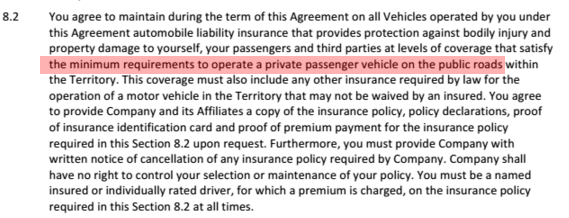

The question is crucial to Malaysians, since Uber only requires its drivers to have an insurance coverage that "satisfies the minimum requirement to operate a private passenger vehicle on public roads".

This is laid out in the agreement Uber drivers must sign when they become Uber partners.

This is laid out in the agreement Uber drivers must sign when they become Uber partners.

Responding to the query from Malaysiakini , the General Insurance Association of Malaysia (Piam) said private car insurance does not cut it for drivers who engage in ride-sharing activities.

Piam chairperson Chua Seck Guan said the private car insurance would be rendered useless if drivers engage in ride-sharing, which is deemed to be a commercial activity.

"Therefore owners of such vehicles, drivers and passengers who use their private cars for commercial use will not be able to claim, under their insurance policy, in the event of an accident.

"This risk has to be assumed by the owner himself, who becomes uninsured because the car would have been used for a purpose not covered under the insurance policy. This inclu

des liability for any third party claim as well," said Chua.

des liability for any third party claim as well," said Chua.

Furthermore, the Piam representative said, ride-sharing drivers risk facing lawsuits from insurers.

"Under the law, insurers may find themselves having to pay for bodily injury claims to other third parties (TPBI claim), excluding the driver and passenger.

"However, the insurer will have a cause for action against the owner and/or driver, and will recover the full TPBI claim settlement and costs incurred from the owner and driver," said Chua.

In Malaysia, a private car is required to have third party insurance policy to cover the liability, including injuries or death caused by the driver, on the other party in an accident, as well as loss or damage to the third party property.

This policy is cheaper than the comprehensive insurance policy, which covers the insured driver's vehicle damage, on top of third party liability. Both types of insurance do not cover passengers.

Uber has own insurance, but grey areas remain

Prior to Piam's response, Uber Malaysia general manager Leon Foong, in an interview with Malaysiakini , stayed coy when asked about a hypothetical situation where Uber drivers are required to take up commercial car insurance.

Malaysiakini has contacted Foong again, in light of Piam's announcement, and is awaiting his response on this.

However, in that interview, Foong

(photo)

gave his assurance that Uber has taken upon itself to provide insurance for passengers and other third parties, such as if a pedestrian gets hit by a Uber driver.

However, in that interview, Foong

(photo)

gave his assurance that Uber has taken upon itself to provide insurance for passengers and other third parties, such as if a pedestrian gets hit by a Uber driver.

“We work with a very well-known insurance company and they cover all the rides. This is (third party) contingent liability which covers up to RM1 million," he said, but declined the reveal the insurer.

Foong said that with complete documentation, insurance claims with Uber would typically be disbursed within a month.

He added the company has completed several claims from customers, but stressed that no major accidents involving its drivers in Malaysia have ocurred.

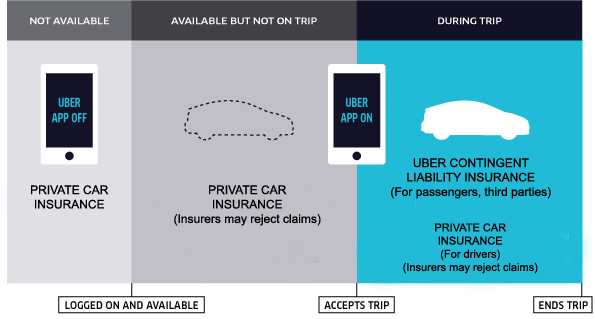

However, Uber's third party contingent liability insurance is not without its problems, as Foong revealed that it only kicks in when Uber drivers accept a ride request from passengers on its application.

This leaves a gap for the period when a Uber driver is logged onto the application while on the road but has yet to accept any ride request, for which he (or she) would be uninsured.

This is in contrast with Uber in the United States, which provides a coverage of US$100,000 for drivers the moment they sign on the Uber application and a US$1 million contingent liability coverage once they accept a ride request.

Foong said this "gap" is not covered as Malaysian insurance companies do not offer such coverage.

The question then is: what happens if an Uber driver accidentally knocks into someone while logged onto the Uber application but has yet to accept a ride request?

Debate surrounding this issue has already raged in several countries, where some argue this period is considered "private use" and "commercial use" only comes into effect when a ride request is accepted.

However, insurers are less than keen on the idea that the vehicle they insure can change between "private" and "commercial" use, like a switch, and may challenge its legality, creating a legal grey area.

Aside from this, another grey area faced is by Uber drivers themselves, as Foong said Uber's insurance in Malaysia only covers passengers and third parties but not the drivers themselves.

"Drivers are covered by their own policy," he said.

With Piam indicating that private insurance policies would become void for ride-sharing drivers, and Uber not covering its own drivers, this would put them in a spot.

These grey areas highlight the challenges faced by the Land Public Transport Commission (Spad), which has to look into a scope of reforms that go beyond finding a solution to end the war between taxi drivers and ride-sharing services.

Until Spad addresses these grey areas, the safest bet is to take Piam's advice.

"If the owner of a private car wishes to hire out his/her car for a 'ride sharing' purpose; firstly to ensure that he will be covered by his insurance company, he is advised to convert his car class for road use to commercial use at the Road Transport Department (JPJ).

"He can then purchase a commercial vehicle insurance policy from his insurer," said Chua.

However, commercial vehicle insurance comes at least double the cost of a private car insurance and commercial vehicles are also subjected to various other checks.

This would mean ride-sharing drivers will incur an additional cost, thus reducing their competitive edge against taxi drivers.

Can criminals become Uber or taxi drivers?

Aside from insurance issues, there is also the question of how safe Uber rides are.

This is in light of a high-profile incident in Delhi, India, last year where a woman was raped by an Uber driver.

Foong gave his assurance that all Malaysian Uber drivers would be given a background check by a third party.

“After the (Uber driver's) application is submitted, we let a certified third party company to do a background check on the person, within 24 hours…

“There has to be zero criminal history and clean record in the past seven years in order to be Uber driver," Foong said.

He added that the company has the necessary government certification and licence to conduct such checks, but declined to reveal the name of the company.

However, in the India Uber rape case, the rapist, Shiv Kumar Yadav

(photo)

, succeeded in fooling Uber's background checks by using forged documents.

However, in the India Uber rape case, the rapist, Shiv Kumar Yadav

(photo)

, succeeded in fooling Uber's background checks by using forged documents.

Uber has since vowed to conduct more in-depth background checks of its drivers.

While the credibility of Uber's background checks may be debatable, there is no known mechanism for background checks on taxi drivers.

The Malaysian Crime Prevention Foundation had in October last year urged Spad to check on the criminal records of taxi licence applicants.

It had also called for taxi associations to take background checks seriously, but there has been no follow-up from the government.

RELATED STORIES:

PART I: The taxi-Uber war: A tale of two drivers

PART II: Sky-high fees doom cabbies to being Uber-losers

PART III: Change - is the taxi industry ready for Uberfication?