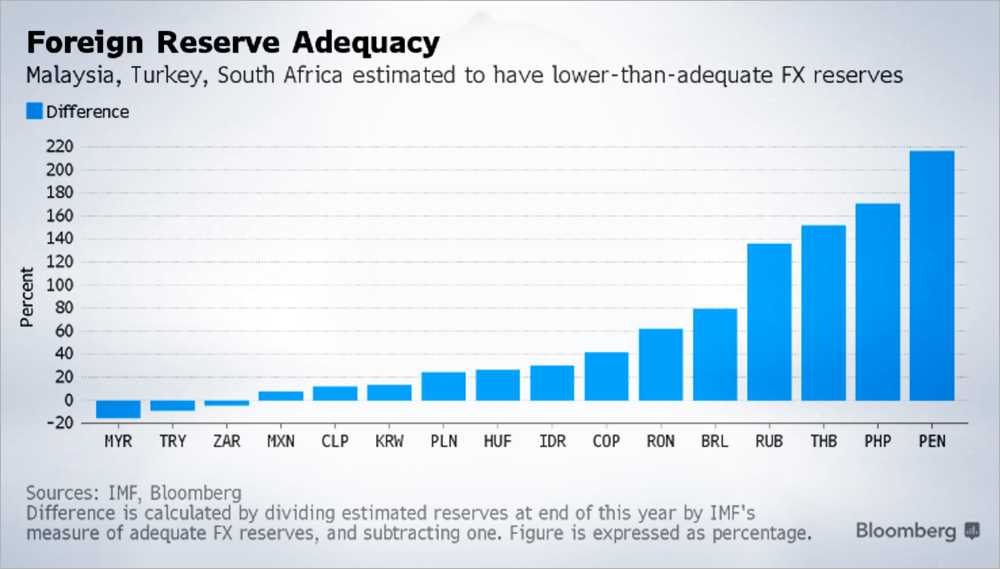

Malaysia ranks worst in terms of its deficit of foreign currency reserves compared to external debts, leaving it the most vulnerable to currency attacks and capital outflows.

Bloomberg yesterday reported that a study of International Monetary Fund's (IMF) measure of the buffer between foreign reserves and debt showed Malaysia in the weakest position, with Turkey, South Africa and Mexico close behind.

"The measure shows Malaysia - not coincidentally the worst performing of the major emerging Asian currencies against the dollar this month - faring poorly by comparison, with a US$100 billion reserves projection against short-term external debt of US$128.2 billion, based on IMF estimates," it said.

The gauge helps identify which countries have the strongest buffers against capital outflows toward developed markets as US interest rates are poised to keep climbing following US president-elect Donald Trump's electoral victory.

“Malaysia and Turkey are classic example of countries whose reserve levels are falling to a critical level in comparison with the amount of their short-term external debt.

"When the overall market trend is down, investors are looking for who is more vulnerable and weak reserve position is also highlighted,” Bloomberg quoted Takahide Irimura, an economist at Mitsubishi UFJ Kokusai Asset Management Co, saying.

Meanwhile Tsutomu Soma, general manager of fixed-income department in Tokyo at SBI Securities Co, said countries with a poor buffer will face greater risk of attacks.

“In this broad trend of the dollar strength - or emerging-market currency weakness - the currencies of countries that have plenty of reserves will probably perform better than others.

“You don’t attack the currency when you know the monetary authorities have plenty of money to intervene.

"Instead, you look for a currency that has less ability to defend it,” he was reported saying.

Malaysia’s reserves are well down from a May 2013 high, said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group Ltd in Singapore, and the slimmer adequacy ratio "limits the ability for Bank Negara to intervene".

While Bank Negara insists its foreign currency reserves are at a "comfortable level", the ringgit has continued its slide down to 4.458 to the US dollar yesterday.

Depleting reserves across Asia

The measure developed by the IMF showed Thailand and the Philippines may be best placed to withstand further downward pressure on the emerging currencies in Asia, said Bloomberg.

Called the 'assessing reserve adequacy' gauge, it incorporates criteria from short-term debt to money supply, imports and investment flows.

It is based on calculations taken before the "Trump-induced US reflation play roiled the foreign-exchange market".

IMF forecast last month Thailand’s reserves were at US$163.3 billion at year-end, compared with the $64.9 billion needed, while the Philippines reserves were at $84 billion against a US$31 billion need.

However Bloomberg noted Asian countries have been using their reserves to "prevent disorderly declines, likely making the IMF’s year-end projections unattainable".