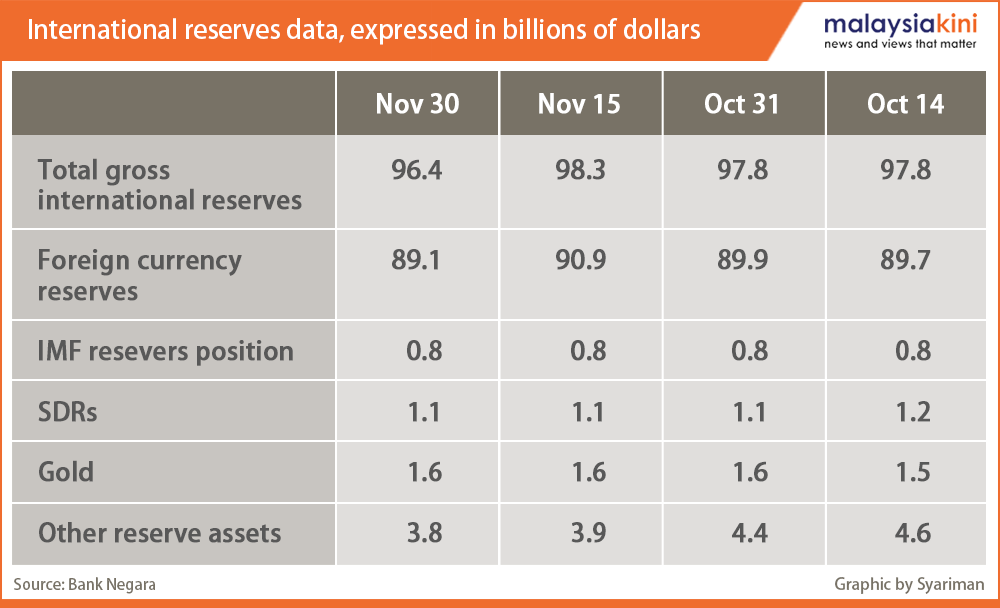

Malaysia’s international reserves fell by nearly US$2 billion in the last two weeks of November, and some economists expect the total to decline further this month.

Malaysia’s central bank said today that gross international reserves stood at US$96.4 billion as of Nov 30, down from US$98.3 billion on Nov 15.

The reserves are at their lowest level since mid-March. Bank Negara Malaysia (BNM) said they were sufficient to finance 8.3 months of retained imports and were 1.2 times the short-term external debt.

“The lower international reserves position reflected the liquidity support in the foreign exchange market,” it said.

The ringgit has slid nearly 5 percent since Nov 9, as foreign investors fled Malaysia’s bond market after yields spiked on speculation that president-elect Donald Trump could impose stimulus policies that raise the US inflation rate.

Suhaimi Ilias, chief economist of Maybank Investment Bank Bhd, said reserves could drop further in December’s first half “before things stabilise again” but any decline shouldn’t be

severe as there should be higher repatriation of export earnings.

“There seems to be still some selling by foreigners in the (Malaysian) equity market,” Suhaimi said.

On Dec 2, BNM announced several measures to boost liquidity and encourage domestic trade of the ringgit in efforts to stem the currency’s slide against a rising US dollar.

It said that exporters could only retain up to 25 percent of export proceeds in a foreign currency, while the remainder must be converted into ringgit.

Earlier today, the government announced that exports in October fell 8.6 percent from a year earlier, the biggest drop in 18 months.

- Reuters

M'sia fares worst in reserves to debt deficit index, says report