COMMENT | G25 would like to extend our congratulations for the commendable effort made by Pakatan Harapan in its emphasis on good governance in its election manifesto.

We appreciate its political courage to undertake institutional reforms. It speaks well of Harapan’s intention to strengthen government institutions as one of the pillars of its reform efforts to establish a clean and efficient government.

We at G25 have been advocating that Malaysia must restore good governance in order to attain sustainable growth with social and economic stability. We favour no political parties, but welcome proposals to undertake reforms on the economic front and restore sound management of the country’s finances.

These reforms must be supported by putting in place good governance practices so that citizens and investors are confident that the rule of law and fundamental liberties will be implemented through appropriate regulations, procedures and processes with the necessary checks and balance respectful of a parliamentary democracy, across the judiciary and all public-sector institutions.

We welcome in particular the Harapan proposals for ensuring clean and fair elections, empowering Parliament with oversight responsibilities on the executive arm of government and for decentralising federal powers to state and local authorities. All these reforms at the political level will promote a more transparent and open government, thereby reducing the nepotism, cronyism and corruption associated with the excessive concentration of power at the centre.

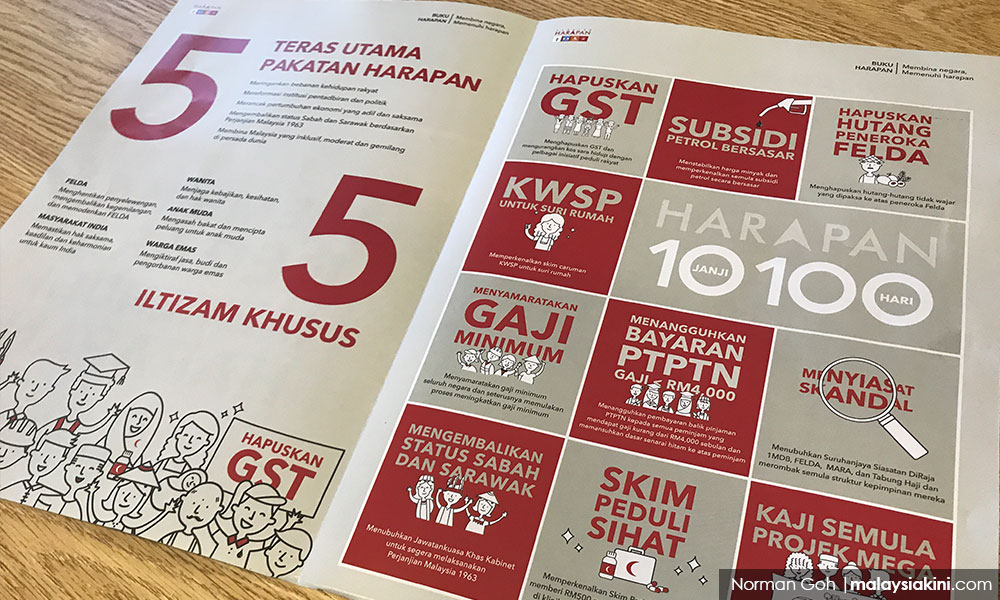

G25 would like to state that while we welcome the wide-ranging reforms and social oriented programmes outlined in the Harapan manifesto, we are also concerned over the proposals to abolish the GST and reinstate the fuel subsidies as these will have a negative impact on the federal budget.

Although the manifesto mentions that the Harapan government will manage public finance with prudence and transparency to minimise wastage and abuse, nevertheless, the proposal to abolish the GST, in favour of its predecessor the sales and services tax (SST), which Malaysia and many countries have found to be a less efficient way of taxing consumption, will have a negative impact on government revenue and make the budget deficit more difficult to control.

The country has been running on a budget deficit for several years now. The deficit situation has improved since the implementation of the GST in April 2015. This consumption tax serves as a useful buffer against the ups and downs of the economic cycle and should, therefore, be retained to keep the revenue system strong.

That being said, necessary improvements to address problems associated with the implementation of GST, such as its impact on the disposable income of B40 households as well as on business efficiency (speed of repayment of rebates/credits to help companies’ cash flow positions), should still be made.

Long-term implications on tolls

Similarly, G25 is concerned about the long-term implications to take over the 31 toll highways, including Plus, by paying the companies compensation to abolish tolls. The billions of ringgit that it would take for the compensation expenditure would be better spent on health, education and a social safety system.

Backtracking on the tolls is detrimental to investor confidence, as it would send a signal that commercial agreements signed with the government on privatisation projects, for which the companies have issued long-term bonds and raised bank loans, can be reneged with changes in administration.

Sustainable investment requires certainty in honouring contracts based on laws and regulations. We would like to remind that government actions which are tantamount to nationalisation will send jitters among the investing community.

Bringing back the fuel subsidies is extremely risky. It took decades of policy discussions and in-depth studies and analysis to move towards a market-based fuel pricing to promote efficiency in business decisions and innovation in energy consumption.

The fiscal gains from subsidy rationalisation are substantial and can be used more productively in the continued expansion of infrastructure to support businesses as well as social and other amenities to raise living standards and the quality of growth.

We would like to urge Harapan to be cautious about its populist proposals on the issue of taxation as well as on its proposals on subsidies as they will have very serious implications, not only on the fiscal balance but also on the stability of the entire financial sector. Such a situation will put pressure on the ringgit and cause uncertainties on the future of the economy.

Changing everything for the sake of change is not wise. Harapan should concentrate its reforms on institutional integrity and governance (across Parliament, judiciary and the public service), education, health, social safety nets, labour and taxation policies for higher wages and disposable incomes.

It is the reforms on both the economic and structural fronts focusing on checks and balance in a parliamentary democracy that will ensure good governance to secure long-term sustainable and equitable growth with social and economic stability.

Above all, G25 hopes that all political parties will show true leadership and courage in managing our race relations and religious tolerance to strengthen national unity.

All politicians elected to Parliament and holding public office should be committed to uphold the Federal Constitution as the basis for law and order which is most fundamental for our country’s development.

G25 is a collective of top Malay Muslim professionals and former civil servants.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.