LETTER | The recent study by Professor Geoffrey Williams on the financial landscape of private higher education institutions (HEIs) has led to much discussion on the future of Malaysia’s private higher education sector.

In the study, 53 percent of the 96 private HEIs under scrutiny were deemed to be making losses before tax, leading many to call for financial aid and more attention from the government.

While I can certainly relate to the alarming nature of the dichotomy, I’m also concerned by the cacophony of requests that may be knee-jerk in nature.

Firstly, it is a fallacy to think that any bailout or aid package from the government will fix the problems in one fell swoop. Doing so may sustain operations at loss-making affected HEIs. But at what cost and for how long?

Malaysia has more than 400 private HEIs. Doing a number crunch with the 53 percent statistic, we are potentially looking at more than 200 HEIs that require financial aid to different degrees.

With this in mind, any form of intervention would likely be a Sisyphean task. Loss-making HEIs may stay afloat in the short run but without a boom in student numbers, they will end up in the red again.

It has also been mooted that consolidation and mergers could be a way forward. While this could address the problem of an overcrowded market, no prudent organisation would want to take over or merge with HEIs that are deemed to be at risk.

All things considered, addressing the malaise in the private higher education sector will require a mix of more money and more reform, with the latter taking precedence in this case.

Having spent a good 33 years in the industry, I’ll be bold in postulating that the time is ripe for the introduction of the university endowment model.

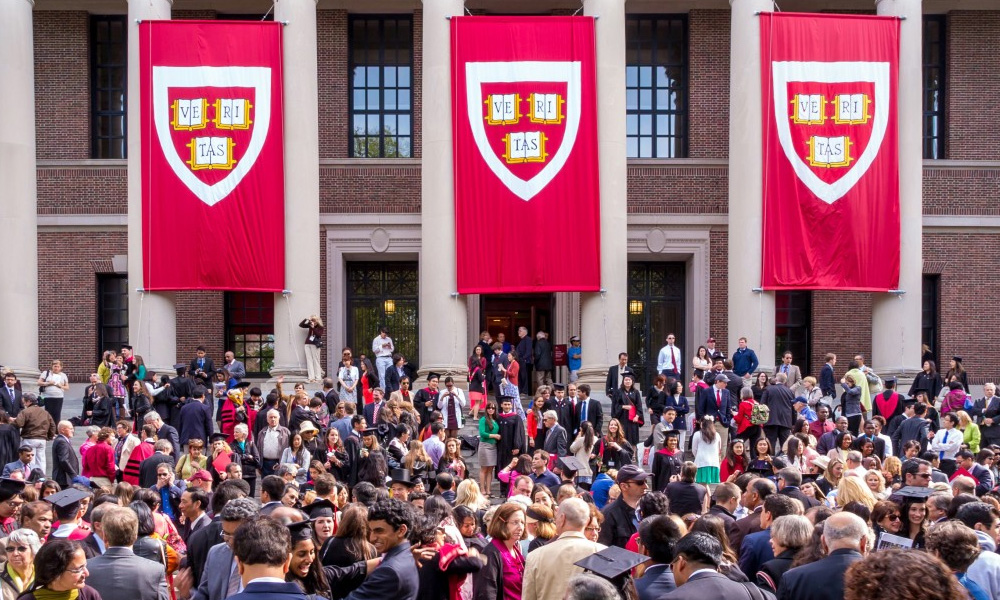

While it may be something of a novelty in Malaysia, it is widespread in the US, Britain and other parts of the world. In fact, the very best universities have been running this model for many decades.

In the US alone, Harvard, Yale, Stanford and Princeton boasted endowment funds of US$39.2 billion (RM162.1 bil), US$29.4 bil (RM121.6 bil), US$26.5 bil (RM109.6 bil) and US$25.9 bil (RM107.1 bil), respectively, at the end of the 2018 fiscal year.

Originally sourced from donations, these funds are subsequently invested to ensure perpetuity. Overseen by investment professionals and fund managers, endowments are normally invested in a diverse portfolio of equities, hedge funds, real estate, bonds and natural resources.

The overarching strategy in endowment fund management is to generate substantial real returns to cover annual withdrawals without reducing the principal, while constantly increasing the principal to account for inflation.

Over the past year, Harvard’s fund grew by 10 percent, Yale’s climbed 12.3 percent, Stanford’s gained 11.3 percent and Princeton’s earned 14.2 percent – all exceeding the estimated 8.4 percent gain a typical 60-40 portfolio of S&P 500 stock and aggregate bond index equities would have delivered over the same period.

These massive funds empower universities to advance research, support immense wage bills, provide financial aid and cover operating expenses, among others.

Typically, about 5 percent of a fund’s total asset value is spent annually and this is enough to cover a significant portion of a university’s operating expenses. For example, this allocation sufficiently covered 67 percent of Princeton’s expenses, 38 percent of Harvard’s, 35 percent of Yale’s and 22 percent of Stanford’s in 2017.

It must be noted that around 70-85 percent of a university’s endowment – common figures at many US universities – is made up of funds with restrictions at the behest of donors. Universities must then exercise their fiduciary duty to ensure the endowments serve their original intention.

For example, an RM5 mil donation to facilitate engineering research cannot be used to finance scholarships and grants for engineering students or be transferred to another faculty. Transparency is of paramount importance and donors are updated annually on how their contributions are spent.

Thanks to the endowment, the world’s best universities can eat their cake with one hand and bake with the other. They want for nothing and with such a vast pool of resources to draw from, it is no surprise why they are so far ahead of the global competition.

Empowering Malaysian HEIs to do the same would be a game-changing move. With the endowment, private HEIs can break free of the crippling reliance on tuition fees and do more to provide opportunities that will improve the life chances of deserving students.

Now, courage is essential in any landmark legislature and endowment funds should be exempt from present Registrar of Societies’ requirements – 50 percent of totals must be spent annually – if they are to live up to their promise.

HEIs must be given the autonomy to invest as they see fit, adopting proven long-term investment guidelines that are in place at the world’s best universities.

The feasibility of granting tax-exempt status to private HEIs is another option to consider. In the US, most universities – both public and private – are tax exempt and this also applies to their endowment management companies and the investments they make.

Going back to the earlier study conducted by Professor Williams et al, average profits after tax fell by 78 percent since 2010 and loss-making institutions rose to 55 percent when after-tax figures were evaluated.

Granting tax-exempt status to all HEIs would recalibrate the balance of solvency from the get-go. And if this is a move too far ahead of its time, giving private HEIs a tax cut would also ease the burdens.

It is not an unreasonable thing to do. Private HEIs have long enhanced access to higher education and contributed immensely to Malaysia’s rise as a global education hub. In this light, enjoying some empowering legislative reforms would pass as overdue recognition for a sector that is often overlooked.

I’ll close by pointing out that Malaysia’s private HEIs have come so far and many are already punching above their weight, evinced by their presence in various global university rankings.

Imagine what more they could do if they were empowered by the state.

PETER NG is the founder of UCSI University.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.